High-Impact Ideas

Recent Posts

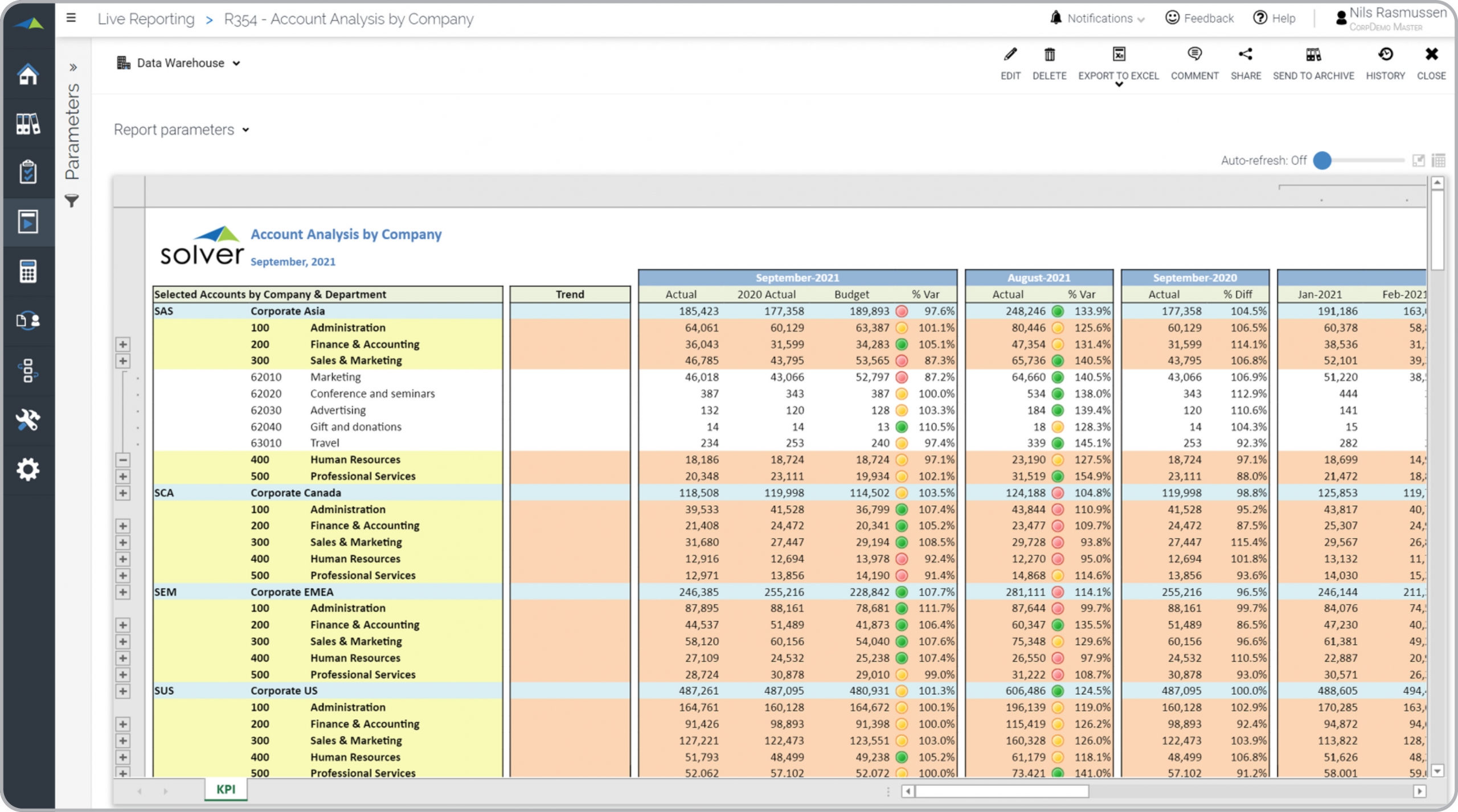

Multi-company Account Analysis Report

Multi-company Account Analysis Report Example[/caption] You can find hundreds of additional examples

here.

Who Uses This Type of

Report

? The typical users of this type of report are: Executives, CFOs and Controllers.

Other

Report

s Often Used in Conjunction with

Multi-Company Account Analysis Reports Progressive Finance & Accounting Departments sometimes use several different Multi-Company Account Analysis Reports, along with financial statements and other management and control tools.

Where Does the Data for Analysis Originate From? The Actual (historical transactions) data typically comes from enterprise resource planning (ERP) systems like: Microsoft Dynamics 365 (D365) Finance, Microsoft Dynamics 365 Business Central (D365 BC), Microsoft Dynamics AX, Microsoft Dynamics NAV, Microsoft Dynamics GP, Microsoft Dynamics SL, Sage Intacct, Sage 100, Sage 300, Sage 500, Sage X3, SAP Business One, SAP ByDesign, Acumatica, Netsuite and others. In analyses where budgets or forecasts are used, the planning data most often originates from in-house Excel spreadsheet models or from professional corporate performance management (CPM/EPM) solutions.

What Tools are Typically used for Reporting, Planning and Dashboards? Examples of business software used with the data and ERPs mentioned above are:

Multi-company Account Analysis Report Example[/caption] You can find hundreds of additional examples

here.

Who Uses This Type of

Report

? The typical users of this type of report are: Executives, CFOs and Controllers.

Other

Report

s Often Used in Conjunction with

Multi-Company Account Analysis Reports Progressive Finance & Accounting Departments sometimes use several different Multi-Company Account Analysis Reports, along with financial statements and other management and control tools.

Where Does the Data for Analysis Originate From? The Actual (historical transactions) data typically comes from enterprise resource planning (ERP) systems like: Microsoft Dynamics 365 (D365) Finance, Microsoft Dynamics 365 Business Central (D365 BC), Microsoft Dynamics AX, Microsoft Dynamics NAV, Microsoft Dynamics GP, Microsoft Dynamics SL, Sage Intacct, Sage 100, Sage 300, Sage 500, Sage X3, SAP Business One, SAP ByDesign, Acumatica, Netsuite and others. In analyses where budgets or forecasts are used, the planning data most often originates from in-house Excel spreadsheet models or from professional corporate performance management (CPM/EPM) solutions.

What Tools are Typically used for Reporting, Planning and Dashboards? Examples of business software used with the data and ERPs mentioned above are:

- Native ERP report writers and query tools

- Spreadsheets (for example Microsoft Excel)

- Corporate Performance Management (CPM) tools (for example Solver)

- Dashboards (for example Microsoft Power BI and Tableau)

- View 100’s of reporting, consolidations, planning, budgeting, forecasting and dashboard examples here

- Discover how the Solver CPM solution delivers financial and operational reporting

- Discover how the Solver CPM solution delivers planning, budgeting and forecasting

- Watch demo videos of reporting, planning and dashboards

TAGS: Reporting, Solver, report writer, Microsoft, consolidation, template, practice, Acumatica, Netsuite, Finance, GP, consolidating, Business Central, excel, ax, budgeting, Cloud, Software, Tableau, SAP, example, best, Sage, BC, D365, NAV, Intacct, Variance, CPM, report, SL, Management, dynamics, Power BI, analysis report, multi-company

Global Headquarters

Solver Suite

Core Subscription

Company and Resources

© Copyright 2024, Solver All rights reserved.LegalPrivacy

QuickStart and Template Marketplace Overview (2 min) |QuickStart and Template Marketplace Setup (10 min)

Global Headquarters

Solver Suite

Core Subscription

Company and Resources

© Copyright 2024, Solver All rights reserved.LegalPrivacy

QuickStart and Template Marketplace Overview (2 min) |QuickStart and Template Marketplace Setup (10 min)

Global Headquarters

Solver Suite

Core Subscription

Company and Resources

© Copyright 2024, Solver All rights reserved.LegalPrivacy

QuickStart and Template Marketplace Overview (2 min) |QuickStart and Template Marketplace Setup (10 min)

Global Headquarters

Solver Suite

Core Subscription

Company and Resources

© Copyright 2024, Solver All rights reserved.LegalPrivacy

QuickStart and Template Marketplace Overview (2 min) |QuickStart and Template Marketplace Setup (10 min)