Loan Performance Dashboard for Credit Unions

What is

a

Loan Performance Dashboard

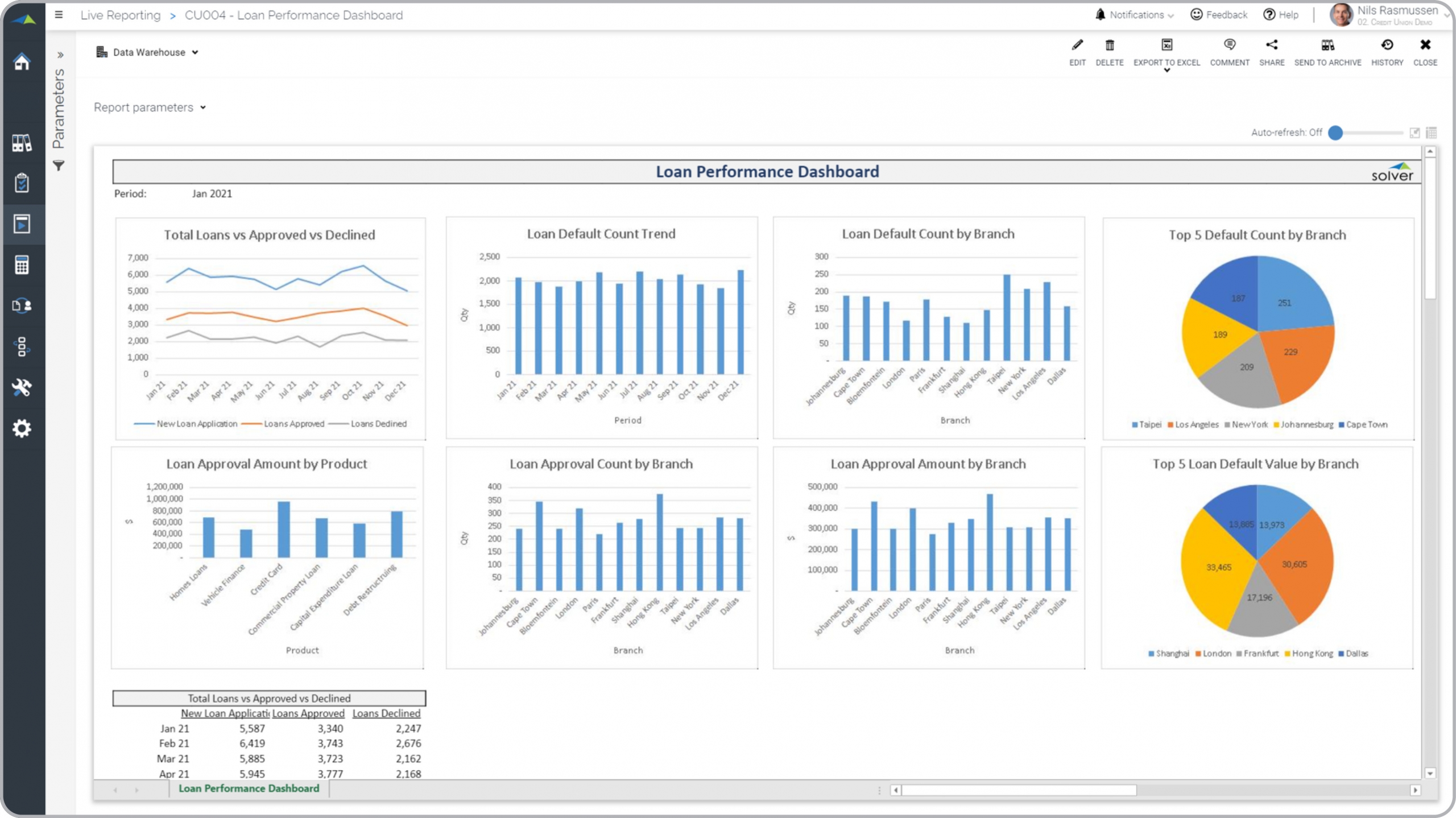

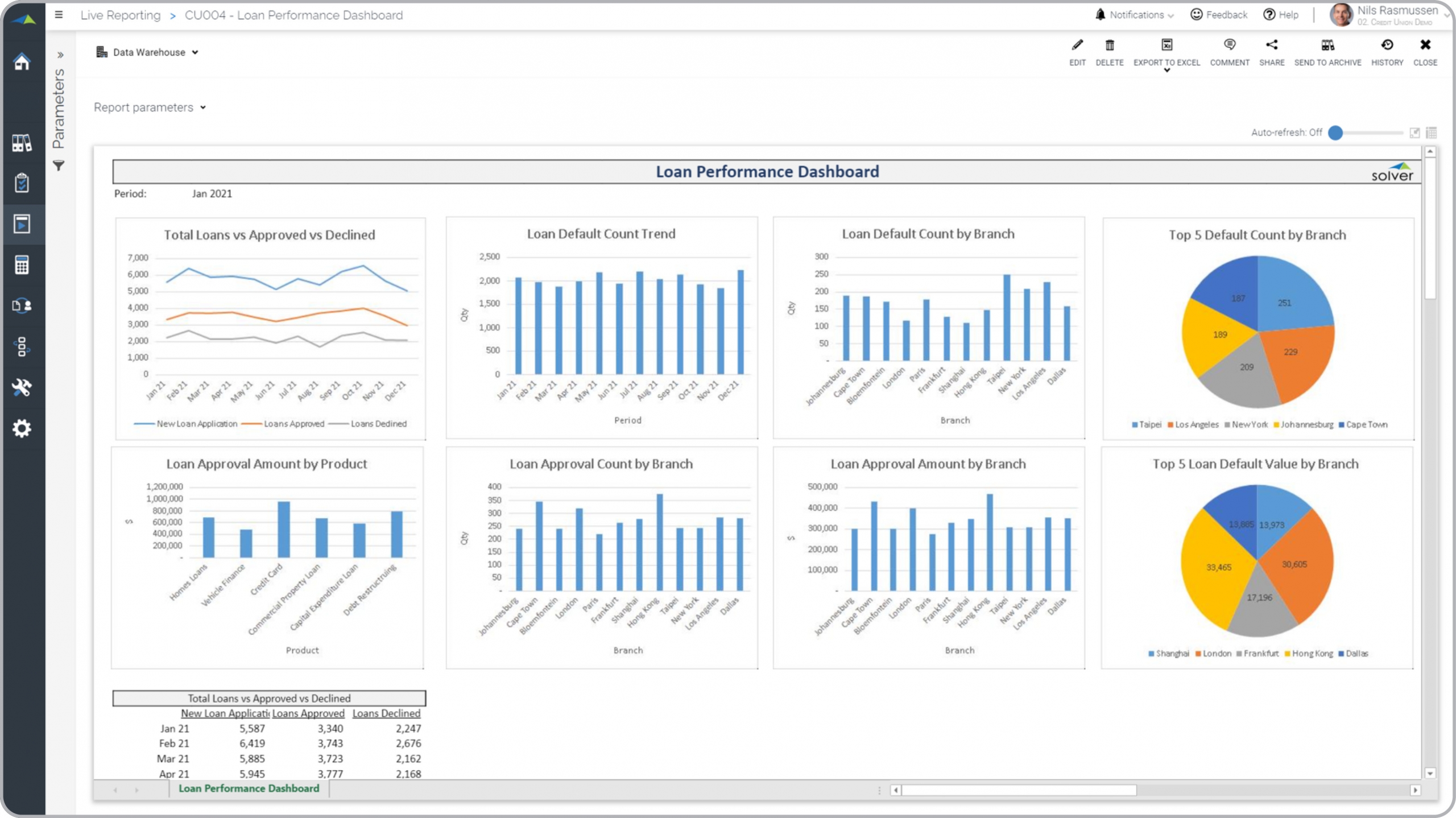

? Loan Performance Dashboards are considered operational analysis tools and are used by executives and loan product managers to monitor trends in approvals and defaults and compare loan metrics across credit union branches. Some of the main functionality in this type of dashboard is that it provides analysis from eight different perspectives including: 1) Monthly trend in total loan applications and loans approved versus declined, 2) Loans approved by product, 3) Monthly trend in loan defaults, 4) Loan approval count by branch, 5) Loan default count by branch, 6) Loan approval amount by branch, 7) Top five loan default count by branch, and 8) Top five loan default amounts by branch. You find an example of this type of dashboard below.

Purpose of

Loan Performance Analysis Dashboard

s Credit Unions use Loan Performance Analysis Dashboard to give leaders an easy way to monitor loan trends and benchmark metrics across credit union branches. When used as part of good business practices in Executive-, Loan- and Financial Planning & Analysis (FP&A) departments, a company can improve its loan strategies and offerings, and it can reduce the chances that potentially poorly designed policies lead to excessive loan defaults.

Example of a

Loan Performance Analysis Dashboar

d Here is an example of a Loan Performance Dashboard with monthly trends and branch comparisons as well as actual to budget comparisons. [caption id="" align="alignnone" width="2560"]

Example of a Loan Performance Dashboard for Credit Unions[/caption] You can find hundreds of additional examples

here

Who Uses This Type of

Dashboard

? The typical users of this type of dashboard are: Executives, CFOs, Loan Managers, Analysts, Regional Managers, Branch Managers.

Other Reports Often Used in Conjunction with

Loan Performance Analysis Dashboard

s Progressive Executive-, Loan- and Financial Planning & Analysis (FP&A) departments sometimes use several different Loan Performance Analysis Dashboards, along with detailed and summary loan reports, profit & loss reports, balance sheets, cash flow statements, budget models, forecasts and other management and control tools.

Where Does the Data for Analysis Originate From? The Actual (historical transactions) data typically comes from enterprise resource planning (ERP) systems like: Microsoft Dynamics 365 (D365) Finance, Microsoft Dynamics 365 Business Central (D365 BC), Microsoft Dynamics AX, Microsoft Dynamics NAV, Microsoft Dynamics GP, Microsoft Dynamics SL, Sage Intacct, Sage 100, Sage 300, Sage 500, Sage X3, SAP Business One, SAP ByDesign, Acumatica, Netsuite and others. In analyses where budgets or forecasts are used, the planning data most often originates from in-house Excel spreadsheet models or from professional corporate performance management (CPM/EPM) solutions.

What Tools are Typically used for Reporting, Planning and Dashboards? Examples of business software used with the data and ERPs mentioned above are:

Example of a Loan Performance Dashboard for Credit Unions[/caption] You can find hundreds of additional examples

here

Who Uses This Type of

Dashboard

? The typical users of this type of dashboard are: Executives, CFOs, Loan Managers, Analysts, Regional Managers, Branch Managers.

Other Reports Often Used in Conjunction with

Loan Performance Analysis Dashboard

s Progressive Executive-, Loan- and Financial Planning & Analysis (FP&A) departments sometimes use several different Loan Performance Analysis Dashboards, along with detailed and summary loan reports, profit & loss reports, balance sheets, cash flow statements, budget models, forecasts and other management and control tools.

Where Does the Data for Analysis Originate From? The Actual (historical transactions) data typically comes from enterprise resource planning (ERP) systems like: Microsoft Dynamics 365 (D365) Finance, Microsoft Dynamics 365 Business Central (D365 BC), Microsoft Dynamics AX, Microsoft Dynamics NAV, Microsoft Dynamics GP, Microsoft Dynamics SL, Sage Intacct, Sage 100, Sage 300, Sage 500, Sage X3, SAP Business One, SAP ByDesign, Acumatica, Netsuite and others. In analyses where budgets or forecasts are used, the planning data most often originates from in-house Excel spreadsheet models or from professional corporate performance management (CPM/EPM) solutions.

What Tools are Typically used for Reporting, Planning and Dashboards? Examples of business software used with the data and ERPs mentioned above are:

- Native ERP report writers and query tools

- Spreadsheets (for example Microsoft Excel)

- Corporate Performance Management (CPM) tools (for example Solver)

- Dashboards (for example Microsoft Power BI and Tableau)

Corporate Performance Management (CPM) Cloud Solutions and More Examples

August 18, 2021

TAGS:

Reporting,

Solver,

report writer,

Microsoft,

approved,

template,

practice,

Acumatica,

Netsuite,

Finance,

credit union,

planning,

GP,

dashboard,

fintech,

Business Central,

excel,

ax,

forecast,

Budget,

Dynamics 365,

analysis,

budgeting,

KPI,

bank,

Cloud,

Software,

Tableau,

SAP,

example,

best,

Sage,

BC,

D365,

NAV,

Intacct,

financial institution,

CPM,

report,

branch,

SL,

Management,

dynamics,

Power BI,

loan,

defaults,

loan kpis,

declined,

loan performance,

loan approval,

loan default,

loan dashboard