High-Impact Ideas

Recent Posts

The Benefits of Budgeting with Budget Templates

The Benefits of Budgeting with Budget Templates

Budgeting is a topic that is not very popular in many organizations. It can be an extremely time-consuming project for many employees. This is why it is important to communicate the significance of a budget to all employees so they take pride and ownership of it. Don’t make complex templates as the goal in estimating for the coming year. If employees can’t have small variances, then they will make decisions that only impact their results against the budget and not what is in the best long-term interest of the organization.

Your budget should be an approximate estimate of how the company will do in the coming year. Provide information on how investment money can be spent. This is based on the strategies and initiatives of the company. The goal should not be to budget down to each dollar.

For example, one company budgeted down to an employee cost of $6.52 per month per employee. The company was asked whether the cost could be estimated as a total for each department, but they claimed they needed it down to the dollar. However, budgeting at the department level and allowing a five percent variance would have had no impact on the decisions that the company made.

Another important item to ask yourself is “what is an acceptable variance for an organization?” For instance, if there is a five percent variance in the revenue, then would this impact the decisions that the company will make in the coming year?

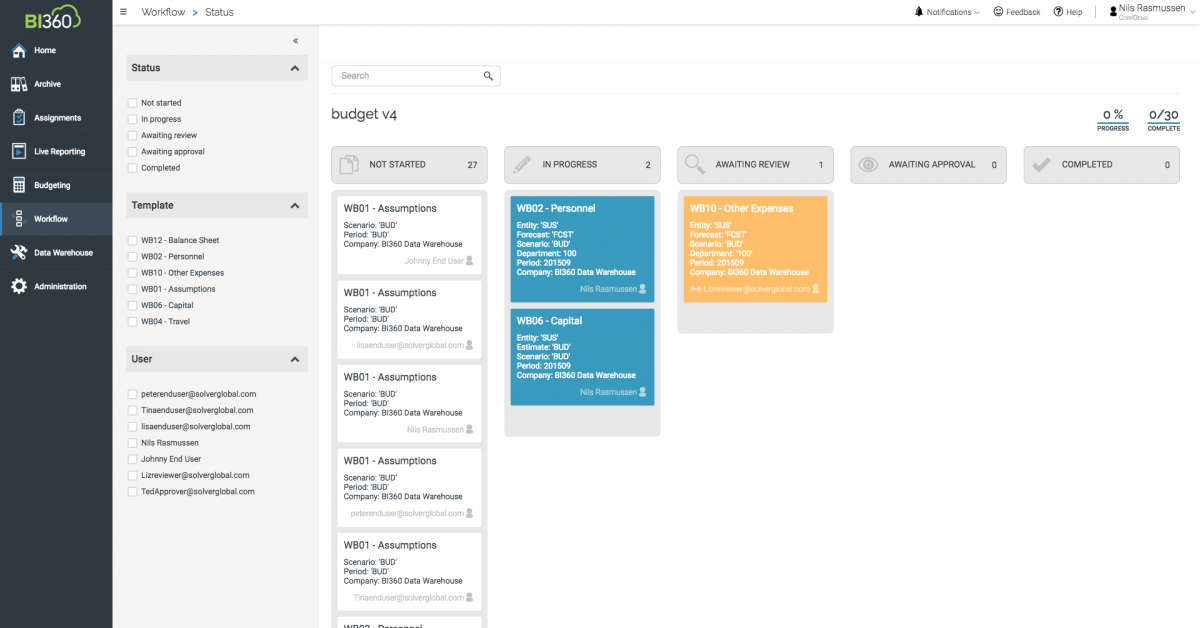

Types of Budgeting Templates

Personnel Budgeting Template

Personnel budgeting has an immense impact for organizations due to the high proportion of costs of an organization. A personnel budgeting template has similarities across all companies. There are many variables to consider, such as the type of raise, how many raises, overtime, bonuses, commissions, taxes, benefits, and IT costs to name a few. It is also important to know whether to budget by employee or by position.

Budgeting by position enables an organization to ignore employee names, terminations, and having to hire employees to replace a terminated employee. It also allows budgeting by multiple employees. As an example, a template can allow a manager to input how many accountants should be employed, what the average salary is, and what the average raise would be. If a company is budgeting by employees then each accountant should be listed. The employee’s exact salary, his/her expected raise, and all other information specific to each employee should be included as well. Budgeting by employee will be more accurate if there is little employee turnover, but it also requires more work.

Other items to keep in mind with personnel is how to allocate monthly salary, which impacts tax and benefit calculations. Allocate salary evenly by work days, by calendar days, and by pay periods. There are other ways as well. Another item to consider is separating out full-time and part-time employees, as there may be differences in the benefits that are allocated to part-time employees, such as overtime and 401k. These are all calculations that must be built into the payroll form.

Assumptions Template

A great first step is creating an assumption template, which allows an administrator to enter data. This will impact the calculations of many templates, and it does not have to be hard-coded into the templates themselves. This data will flow from the form into all other templates. An assumption template should include payroll tax rates, a worker’s compensation rate, and a benefit rate. The number of days in each month also matters. The data from the assumption form will then flow into the payroll form.

There may also be a need to allocate an employee across multiple departments. In this case, there are two options: 1) Budget every employee to a “dummy” department and then allocate the salaries, taxes, and benefits in new template. 2) Upload the employee information into each department and enter the number of hours allocated to each department. This ensures there is an administrator report that checks to verify that an employee does not exceed 2,080 hours a year.

Many companies use another template called the capital expenditures template. This particular template allows users to enter capital expenditures that are projected into the coming year. This also calculates depreciation, typically on a straight-line basis. The asset type is typically chosen because each asset type has a specific life. A capital expenditures template should include asset type, department, purchase description, purchase a month, purchase price, and quantity. The capital expenditures and the monthly depreciation are summarized at the bottom of the template.

Factors that Impact Budgeting Templates

Templates

We’ve talked about assumptions templates, capital expenditures templates and more to help organize your budget. Many companies typically use the expense budget template. The expense budget allows for input for accounts that have not been budgeted already through templates like personnel and capital. There are several ways of handling other expenses. Below are a few recommendations to make the input more accurate and efficient:

Show prior year actual and forecast by account. This allows users to simply compare to the prior year and confidently make sure that they are not under or over budget for each account. Allow users to enter detail for each account. For instance, marketing expenses will be beneficial to know what makes up the monthly amount rather than having employees keep this information separately. Show the accounts that were budgeted in other templates, but also lock the accounts so that the values cannot be modified.

Revenue and cost of sales can be budgeted in a similar template to the expense template above, but many times companies want to get much more detailed. Other templates that can be used are a balance sheet, a travel template, or a budget.

Industry

There are many templates that are being used today. The revenue and cost of sales templates are more industry-specific, and they are built towards the specifications of the organization. It is important to try to use only a handful of templates that can be designed and used across the company. It is also a good practice to create templates that will auto-calculate many of the revenue accounts and cost of sales accounts.

A public sector expenditures template is available after the departmental manager has input his/her adjustments and comments. The baseline budget and the departmental adjustments calculate the departmental requested amount. Other parts of the organization such as the budget office, the executive team, and the board make adjustments to the departmental total to determine the final amount also known as the Board Requested amount.

The retail revenue sample allows users to input unit count by product. This calculates the revenue by multiplying the count by the price per unit. Each month can be expanded to show the individual weeks while the other months are minimized in the example.

The final industry template is a commission template where the employee calculates the monthly salary and commission. This template can also include employee termination.

Tie to Goals

It is extremely important to tie the budget back to the goals finalized for the strategy. If the goals and the budget are not consistent, then what truly are the goals for the company to achieve? As stated in the prior sections, the goals should be communicated to the entire organization so that the budget stays consistent with the goals and there is no confusion among the staff.

There are a few ways to assist the users in knowing the goals and initiatives while entering their budgets and forecasts. It is much more effective to include the information directly in the template than in meetings or documentation.

Top-Down

Top-down budgeting is a valuable first step in the budgeting or forecasting process. It allows a limited use of resources to quickly create a budget or forecast early in the process. It also allows for a comparison to the bottom-up budget, which can take months to complete. There are disadvantages to a top-down approach, but a bottom-up and top-down budget can eliminate that. When a top-down budget is created, it can impact employee morale as they are not invested in the success or failure of the budget. This is because employees do not experience the same ownership in the budget process.

There are several ways to create a top-down budget, but our team has come up with a solution that will enable a budget to be created in minutes. It is called a Breakback template. In this case, a manager or administrator simply enters the desired net income. He or she creates a monthly 12-month budget. He/She can make additional assumptions around specific departments, account groups, or individual accounts.

For instance, the desired net income is $3,000,000. Store the template and create the top-down budget. This enables the user to perform variance reporting. This template is typically used to create either the entire budget or the forecast budget.

Learn More About Budgeting Templates by Solver

If you would like to get a better understanding of the budgeting templates above, you can download the free ebook here. Beyond using the right templates, it is important to have the right team and infrastructure in place to implement a successful budgeting strategy. Take the time on the front end to set budgeting goals that line up with your overarching organizational goals.

We also recommend to ask for help! By asking for help within the right channels, you can ensure the right sounding board that can guide you through the process with minimal time wasted and designed for maximum efficiency. At Solver, we have a team of experience professionals that have taken on countless projects like this one. Between the power of Solver and their expertise, you have all you need to set yourself up for success.

TAGS: ax, KPI, profitability analysis, CPM, strategy, CPM Software, corporate performance management solution, consolidation software, financial consolidation software, FP&A, corporate management software, max credit union, reports, CPM Solution, Microsoft Dynamics NAV, Financial Planning and Analysis, corporate performance management software, financial budgeting software, Host Analytics, corporate performance management tools, financial reporting software, CPM Solutions, best corporate performance management software, financial reporting, corporate performance management solutions, Adaptive Insights, cloud cpm, cpm software companies, Dashboards, financial consolidation, it budget software

Global Headquarters

Solver Suite

Core Subscription

Company and Resources

© Copyright 2024, Solver All rights reserved.LegalPrivacy

QuickStart and Template Marketplace Overview (2 min) |QuickStart and Template Marketplace Setup (10 min)

Global Headquarters

Solver Suite

Core Subscription

Company and Resources

© Copyright 2024, Solver All rights reserved.LegalPrivacy

QuickStart and Template Marketplace Overview (2 min) |QuickStart and Template Marketplace Setup (10 min)

Global Headquarters

Solver Suite

Core Subscription

Company and Resources

© Copyright 2024, Solver All rights reserved.LegalPrivacy

QuickStart and Template Marketplace Overview (2 min) |QuickStart and Template Marketplace Setup (10 min)

Global Headquarters

Solver Suite

Core Subscription

Company and Resources

© Copyright 2024, Solver All rights reserved.LegalPrivacy

QuickStart and Template Marketplace Overview (2 min) |QuickStart and Template Marketplace Setup (10 min)