Related Posts

What You Need to Streamline Your Budget & Forecast Process

Edgar R. Fiedler was an American economist who served as Assistant Secretary to the Treasury between the years 1971-75. Edgar published a series of essays during the late 70’s and early 80’s once pithily stating “If you have to forecast, forecast often” something that seems especially relevant as we navigate the current economic climate of 2020.

As businesses of all shapes and sizes come to terms with the impact of the COVID-19 pandemic, executives and finance professionals continue toadapt to the changing landscape,turning to re-forecasting and scenario planning to help better predict what might be in store for the remainder of 2020 and beyond.>

However, many organizations are finding out they are not as prepared as they should be, and do not have theright forecasting and reporting toolsin place to support effective decision makingduring this difficult period.

Here’s the Problem with Planning Budgeting and Forecasting

Forecasting at the best of times is a tough process. No one said it was easy predicting the future.

You will often hear organizations acknowledge inefficiencies around the whole budgeting and forecasting process, with many companies admitting they’ve put up with system limitations for far too long – inflexibility, no real time data, poor collaboration and lack of security are often cited.

While sub optimal, these challenges may have been at least manageable in a pre COVID-19 world, with organizations able to ‘make do’ with what they have, but today’s heightened environment is shining a light onto these legacy systems that typically rely on a complex web of Microsoft Excel based forms that are no longer fit for purpose.

It’s becoming clear that these budgeting and forecasting bottlenecks are now taking a front row seat and will only serve to hinder an executive’s ability to plot a way forward. Lots of finance teams realize that plans to modernize inhouse budgeting and forecasting tools can no longer be kicked into the long grass.

Top Five Planning Essentials in 2020

So, what exactly do companies have on theirbudget planning tools wish list in today’s world? Many finance professionals are anxious and frustrated as they attempt to re-forecast and plan during these uncertain times.

Here are five key takeaways, in no particular order, captured during recent conversations with finance professionals from a multitude of industries to help improve your planning, budgeting and forecasting methods.

Historical Actuals

Finance teams need actuals to reside in one secure, central location and they tell us this should be in the Cloud. It needs to ‘just happen’ and update in the background on a scheduled basis.

The jury’s decision is unanimous - manual exporting into Excel coupled with the necessary data manipulation and formatting just won’t cut it in today’s world. It takes way too long and is greatly adding to frustration levels as executives continually push finance teams for accurate and meaningful data. A fully featured, structured data warehouse that may have once been viewed as a ‘nice to have’ has now become essential for effective organizational wide forecasting and budgeting.

Multiple Versions & Scenarios

High on the list is a renewed focus on the need to easily create and manage multiple forecasts and budget versions for analysis. Right now, scenario planning is crucial. The need to quickly run what-if analysisacross a variety of different business scenarios has become an absolute necessity. It goes without saying that organizations need this to be on-demand, flexible and fully self-service.

Driver Based Forecasting

Speed and accuracy are vital to the planning process. Most organizations are familiar with the concept of driver-based forecasting, but quite often you will see a form of this deployed using traditional Excel. The following short video illustrates why companies are talking about the need for enhanced driver-based forecasting and budgeting.

Stakeholder Ownership

The planning, budgeting and forecastingprocess has to be a partnership between business managers and finance. Too many finance teams tell us they carry too much of the burden when it comes to the planning process, yet it is difficult to adapt when companies are using traditional Excel models. To encourage wider budget ownership, we are seeing key requirements focused around a need for trackable assignments, automated workflow with review and approval functionality, coupled with a desire for real time updates and easy consolidation at the organizational level.

Cloud Budgeting

This will come as no surprise to anyone, but you won’t find many companies out there without a clearly defined Cloud strategy, and it’s safe to say that this includes forecasting and budgeting systems. Companies with traditional system deployments are now finding themselves fast-tracking cloud services due to the advent of increased remote working. Giving business managers faster and more reliable web-based access to centralized budgeting and forecasting assignments further supports the goal of wider stakeholder ownership, security, and auditability.

How to Save Time & Money Streamlining Your Process

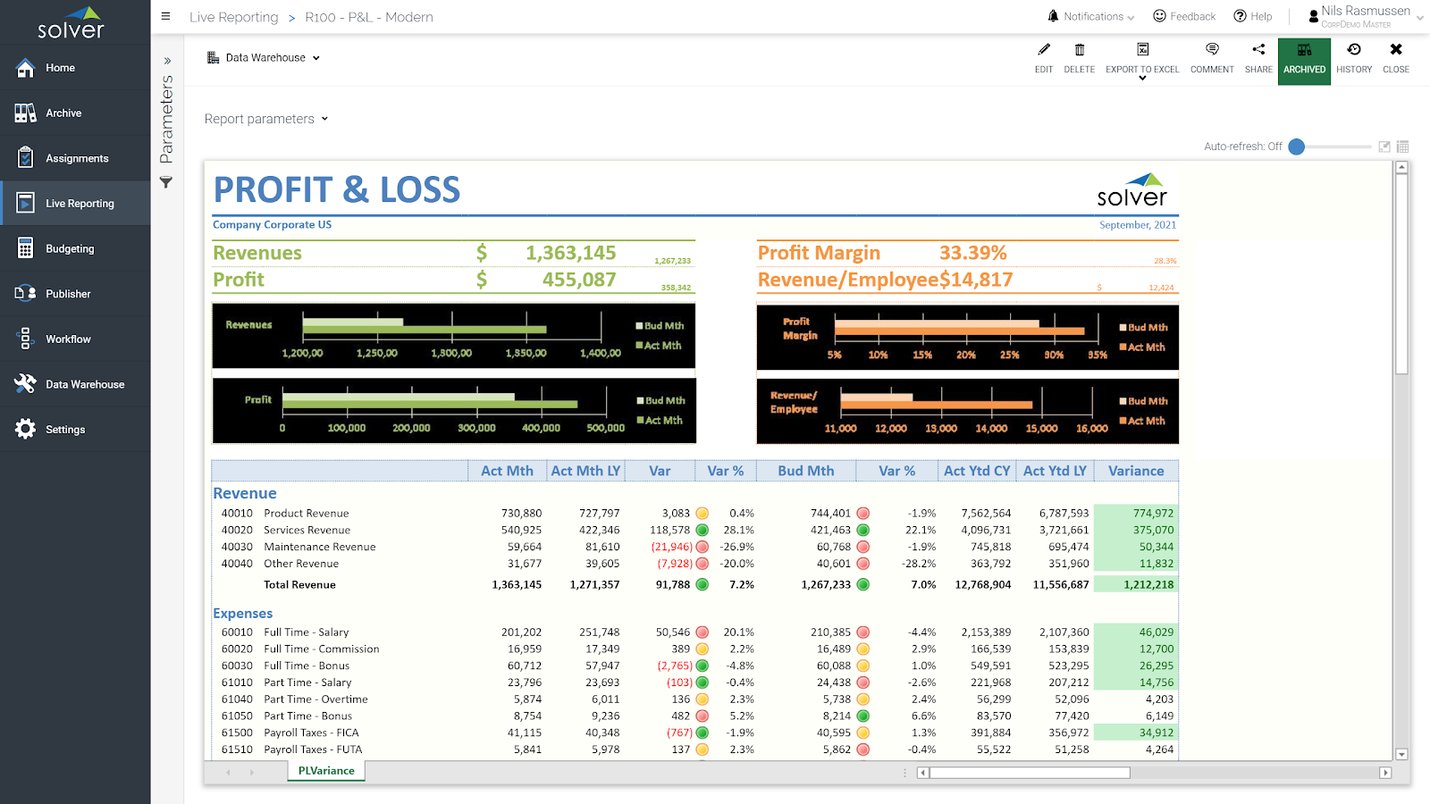

Solver not only supports all departmental budgets but supports revenue details, capital expenses, employee budgets, and more. With Solver, budgeting and reporting processes become tightly integrated and easily accessed, all within a modern Microsoft Excel add-in for dynamic input forms and reports and with a SQL Server database on the back-end.

Plus, with Solver’s highly customizable capabilities, budgeting administrators can set up a centralized workflow with “social” collaboration features so that contributors and approvers can easily communicate objectives, comment, and propose changes, saving valuable time and resources in your budgeting process.

Does your Team Really Have the Correct Budgeting & Forecasting Tools?

Many organizations are using this time to evaluateCorporate Performance Management softwareas an efficient budgeting and forecasting tool.Yes, it’s another acronym into the mix, but if ever there were a finance technology category appropriate for these times, CPM could certainly make a strong play for the top spot.

Global Headquarters

Solver, Inc.

Phone: +1 (310) 691-5300