How to Forecast Cash Flow in Uncertain Times

Nobody likes a budget that is far off target, especially when it could result in a liquidity crisis. Luckily, most companies rarely have to experience such a stressful event. Although, in a turbulent economy where interest rates and stock indexes move up and down like yo-yos and news about corporate layoffs are part of daily news headlines, strong financial clarity does not seem like a bad idea. So, what does a

cash flow forecast mean to most people? Here is a definition:

A cash flow forecast is a plan that shows how much money a business expects to receive in, and pay out, over a given period of time. Based on the definition above, it seems logical that all businesses should have a cash flow forecast perfectly ingrained in their corporate processes, but is that the reality? Let’s take a closer look at this.

There are several very logical reasons why a company can benefit from regular cash flow forecasts, including:

There are several very logical reasons why a company can benefit from regular cash flow forecasts, including:

Most executives would agree that accurate cash flow forecasts provide numerous benefits to their business. During economic turmoil cash flow forecasts can help lower the risk of running into liquidity problems and increasing the chance to be ready to jump on investment opportunities. Regardless of the motivation, there are good tools available to help automate and simplify such financial planning processes. At Solver, we offer Corporate Performance Management Solutions that help you

establish cash flow forecasts and analyses and prepare for uncertain times. Contact one of our expert team members to learn how

we can help you improve your cash flow processes.

Most executives would agree that accurate cash flow forecasts provide numerous benefits to their business. During economic turmoil cash flow forecasts can help lower the risk of running into liquidity problems and increasing the chance to be ready to jump on investment opportunities. Regardless of the motivation, there are good tools available to help automate and simplify such financial planning processes. At Solver, we offer Corporate Performance Management Solutions that help you

establish cash flow forecasts and analyses and prepare for uncertain times. Contact one of our expert team members to learn how

we can help you improve your cash flow processes.

What are Cash Flow Budgets?

Cash flow budgets are a set of elements. In particular, capital requirements, cost of goods, development expenses, operating expenses, and sales and revenue are all highlighted by a cash flow budget. And like every other quality budget, your cash flow projections rely on past performance data. In order to forecast your cash flow, you will begin by looking at your estimated sales for the next year, related to the percentage of business volume produced monthly. You’ll divide each month’s sales by cash and credit sales. Your cash sales can be recorded in the cash flow report in the same month they’re generated. As for your credit sales, they are not credit card sales that are treated as cash, but instead, they have invoiced sales with agreed-upon terms. Therefore, you will want to look at your AR (accounts receivable) records and figure out your typical collection period. You won’t be able to log your credit sales as cash until 5-10 days after the period ends because you are waiting on another bank to receive payment. Next up is other income. More specifically, the next line item on a cash flow statement is the revenue you get from investments, interest accrued on loans that have been extended, and liquidating any assets. The sum of cash sales, receivables, and other income is your total income. In your first month of cash flow budgeting, it will typically be comprised of cash sales, other income, and any receivables from the previous budget that have matured to a collection point during the first month of the current budget.Are All Businesses Doing Cash Flow Forecasting?

As much as it seems to make perfect sense to have a good estimate of your future cash outflows and inflows, many companies never get around to doing it. This is especially true in small and mid-sized businesses. Some of the reasons for the lack of cash flow forecasting models are the following:- The finance staff don’t have time to prepare it

- Lack of tools that automate cash flow forecasting

- Complexity in creating a good cash flow model

- Lack of accuracy in past models leading to reduced appetite to repeat it

- Other business tasks or fires keep executives focused in other areas

- The financial planning team is exhausted after then annual budget process with no time or motivation to re-forecast the budget during the year

Why Do Companies Want to Project Their Future Cash Outflows and Inflows?

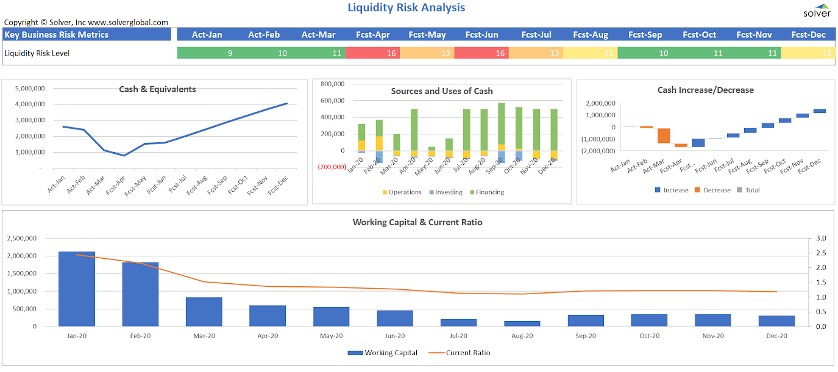

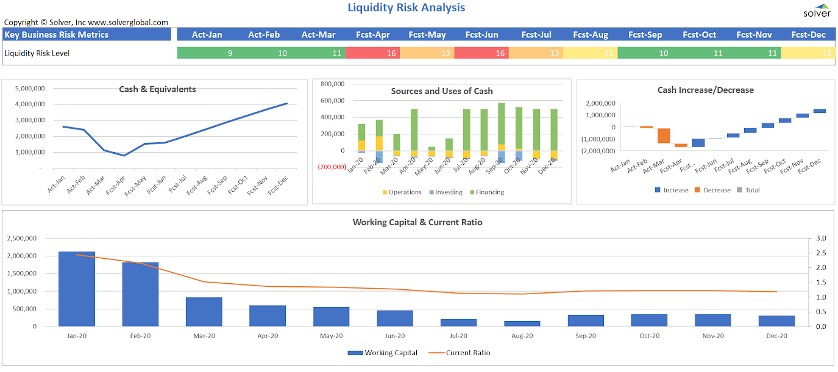

Most executives know they would sleep better at night if they had a mechanism that fairly accurately could tell them if the liquidity of their business is healthy or not in the months ahead. Below is an example of a report using simple color indicators and charts to help managers analyze the company’s projected cash position based on underlying cash flow forecast. There are several very logical reasons why a company can benefit from regular cash flow forecasts, including:

There are several very logical reasons why a company can benefit from regular cash flow forecasts, including:

- Reduce the risk of insolvency – by having a clear idea of any upcoming liquidity issues, management can react early and avoid drama and stress

- Move faster on investment opportunities – if you, thanks to a cash flow forecast, early on know that the business will be flush with cash in the months ahead, you can start planning acquisitions, down payment of high interest debt, purchases of strategic capital assets, etc.

- Satisfy bankers to enable debt financing or other bank-backed financial transactions

How to Automate Cash Flow Forecasts?

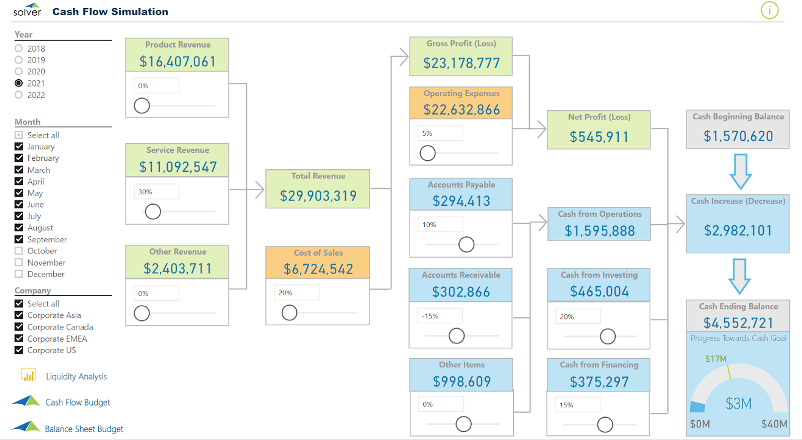

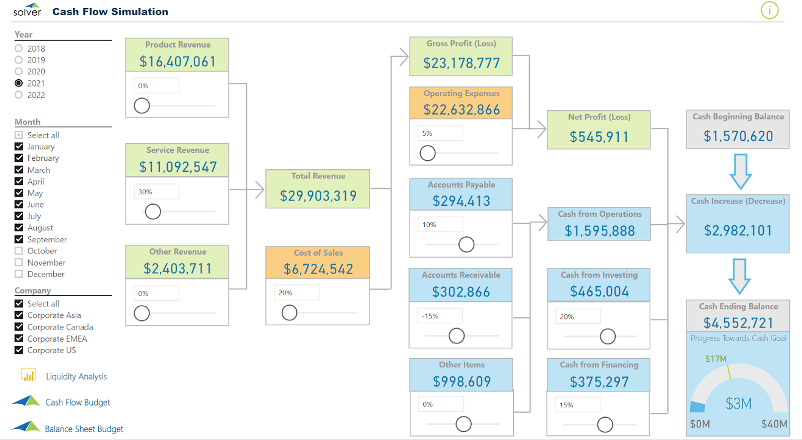

As in many other cases, technology can help automate laborious tasks. In the case of cash flow forecasting, there is a cloud software category often referred to as Corporate Performance Management (CPM) solutions that includes vendors such as Adaptive Insights, Centage and Solver that specialize in planning, budgeting and forecasting. Benefits of CPM tools include scenario forecasting to predict “great”, “good” and “bad” scenarios so managers can plan accordingly. In other cases, CPM solutions provide entire driver-based forecast processes. Driver-based means that the forecast includes assumptions that help automate and simplify creation of sales, payroll, expenses, balance sheet and cash flow forecasts. Sometimes managers don’t have the time or the need for a full forecast to analyze projected liquidity, in which case they can use simulation models to quickly adjust elements of their cash outflows and inflows to see the impact on the cash position as seen in this example: Most executives would agree that accurate cash flow forecasts provide numerous benefits to their business. During economic turmoil cash flow forecasts can help lower the risk of running into liquidity problems and increasing the chance to be ready to jump on investment opportunities. Regardless of the motivation, there are good tools available to help automate and simplify such financial planning processes. At Solver, we offer Corporate Performance Management Solutions that help you

establish cash flow forecasts and analyses and prepare for uncertain times. Contact one of our expert team members to learn how

we can help you improve your cash flow processes.

Most executives would agree that accurate cash flow forecasts provide numerous benefits to their business. During economic turmoil cash flow forecasts can help lower the risk of running into liquidity problems and increasing the chance to be ready to jump on investment opportunities. Regardless of the motivation, there are good tools available to help automate and simplify such financial planning processes. At Solver, we offer Corporate Performance Management Solutions that help you

establish cash flow forecasts and analyses and prepare for uncertain times. Contact one of our expert team members to learn how

we can help you improve your cash flow processes.

Contact Us Today

TAGS: Forecasting, Budgeting, ERP

Global Headquarters

Solver, Inc.

Phone: +1 (310) 691-5300