Learn more about Solver, the leading Corporate Performance Management Solution

Filter Posts

- CPM

- budgeting

- report writer

- forecasting

- report

- Microsoft Dynamics 365 Business Central

- Solver

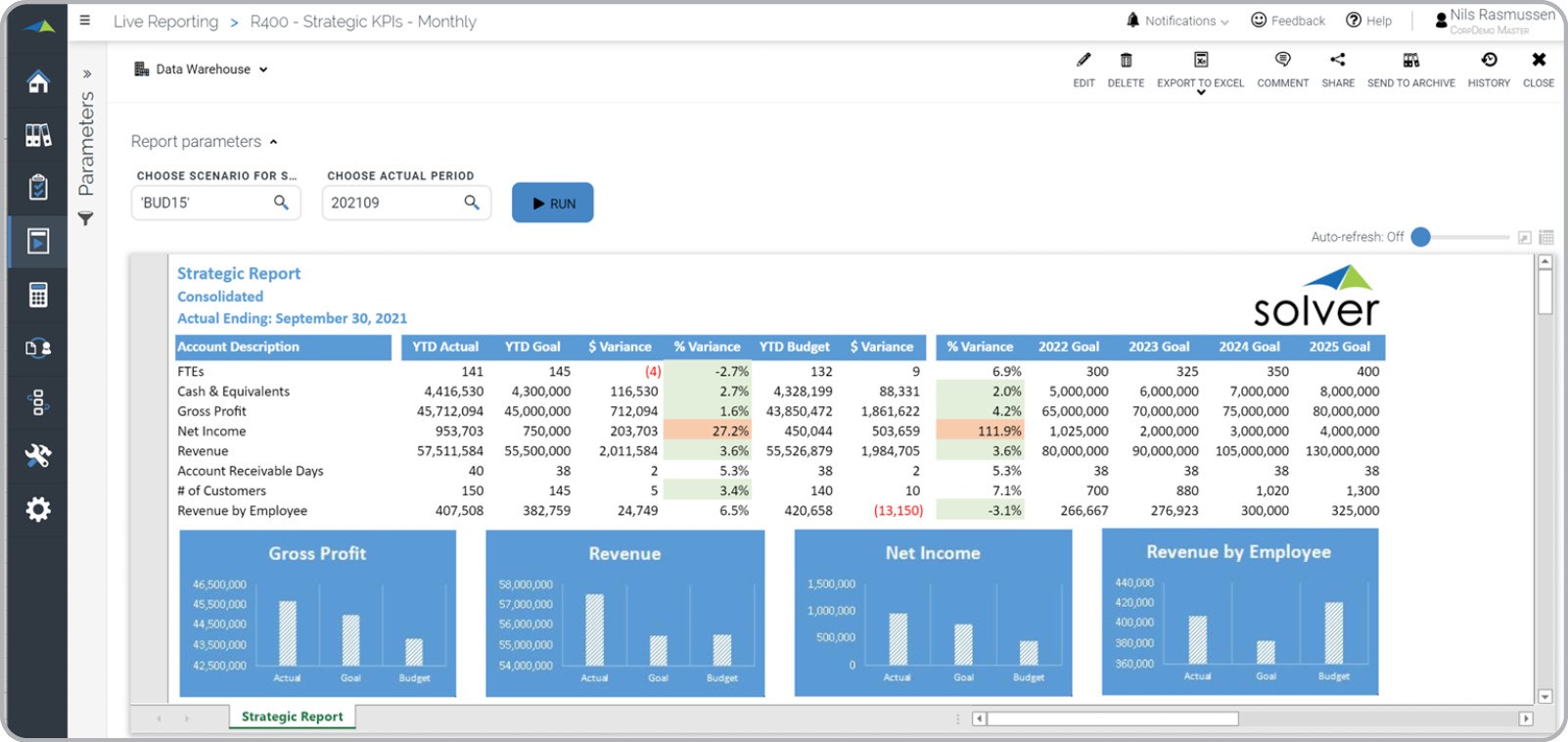

- KPI

- business intelligence

- Corporate Performance Management

- EPM

- excel

- D365 BC

- BI

- integration

- Microsoft

- dashboard

- Cloud

- Power BI

- analysis

- subscription

- Binary Stream

- SaaS

- Budgeting Software

- Subscription BIlling

- Binary Stream Subscription Billing suite

- Intacct

- SAAS company

- SBS

- D365

- Business Central

- dynamics

- SAP

- ax

- Sage

- NAV

- Finance

- GP

- SL

- Tableau

- Netsuite

- Sage Intacct

- Management

- BC

- Software

- best

- example

- practice

- template

- planning

- Reporting

- financial reporting

- SaaS report

- binary stream report

- Acumatica

- consolidations

- prophix

- Dynamics 365 Business Central

- forecast

- BI360

- cloud cpm

- jet reports

- corporate performance management software

- CPM Solution

- Dashboards

- Microsoft Dynamics

- dynamics gp

- CPM Software

- CPM Solutions

- financial reporting software

- Budget

- FP&A

- consolidation software

- corporate management software

- corporate performance management solutions

- SAP Business One

- Vena

- consolidation

- dynamics nav

- Adaptive Insights

- Host Analytics

- Management Reporter

- SaaS KPI dashboard

- anaplan

- CFO

- Dynamics 365

- financial consolidation software

- it budget software

- QuickStart

- d365 finance

- estimate

- financial consolidation

- dashboard templates

- financial statements

- hyperion

- income statement

- Azure

- ERP

- ISV

- Microsoft Excel

- Planful

- projection

- reporting tools

- roi

- sap bydesign

- API

- Adaptive Insight

- Controller

- Excel reporting

- GPUG

- OFFICE OF FINANCE

- Power BI dashboards

- TM1

- Teams

- best corporate performance management software

- best software

- best tools

- data warehouse

- dynamics 365 finance

- pre-built dashboards

- software comparison

- Financial Planning and Analysis

- GL

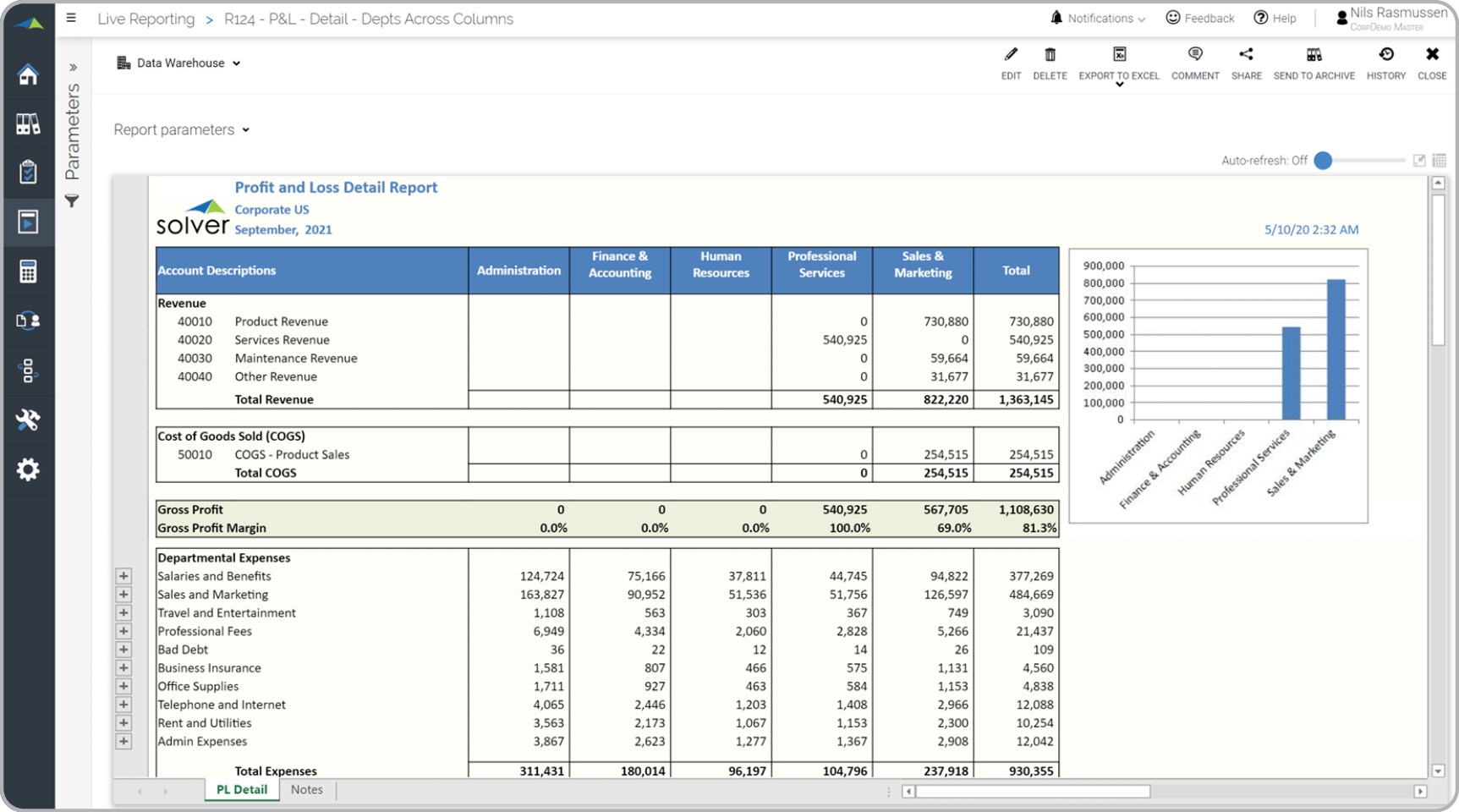

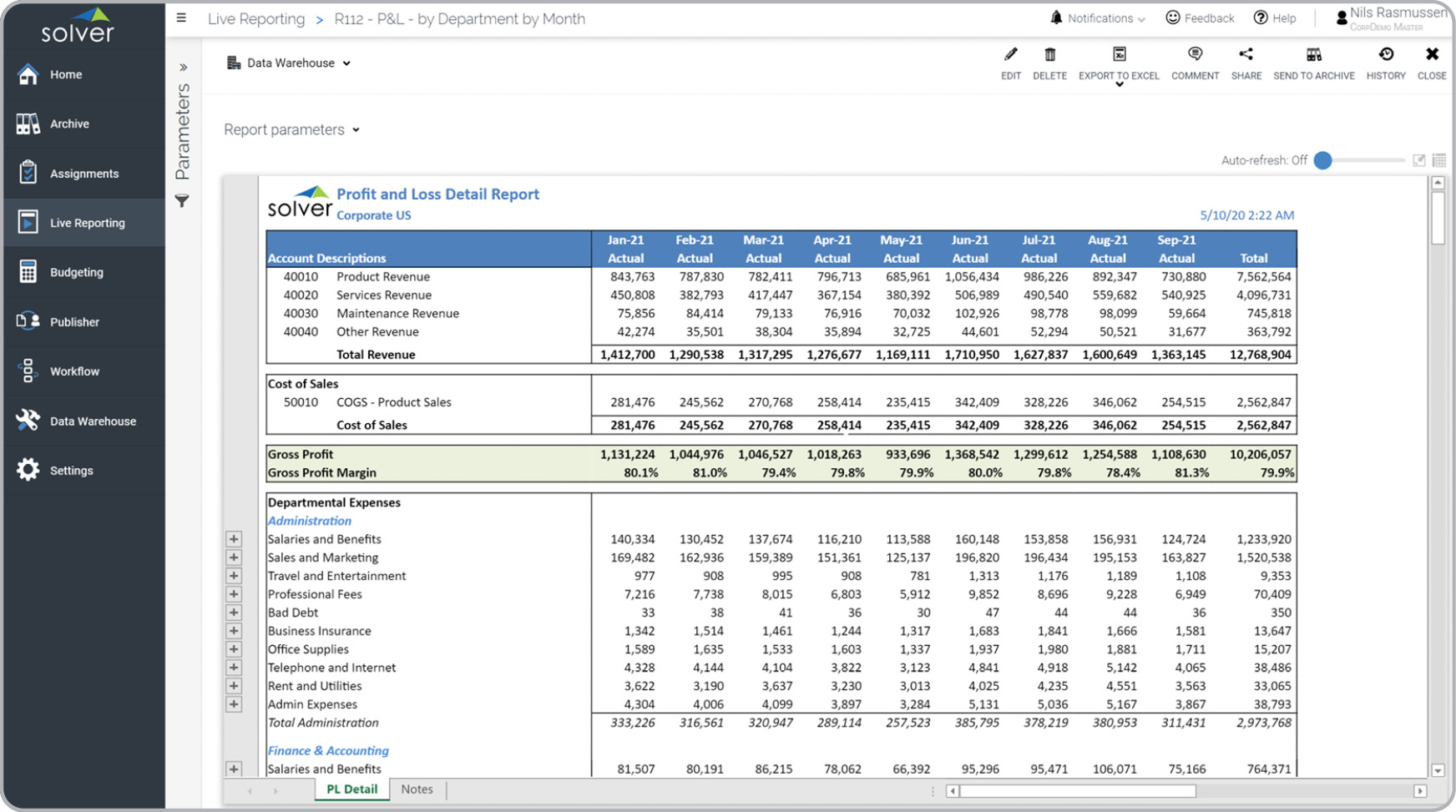

- P&L

- PowerPoint

- SSRS

- SaaS KPI

- Sage 500

- appsource

- dynamics ax

- input

- modelling

- sage x3

- EVALUATION

- Financial Planning

- Microsoft Dynamics NAV

- Oracle

- OutlookSoft

- Sage 100

- Sage 300

- account schedules

- cognos

- comparison

- corporate performance management solution

- dynamics sl

- max credit union

- monthly

- planning process

- profitability analysis

- sales

- AR

- ARR

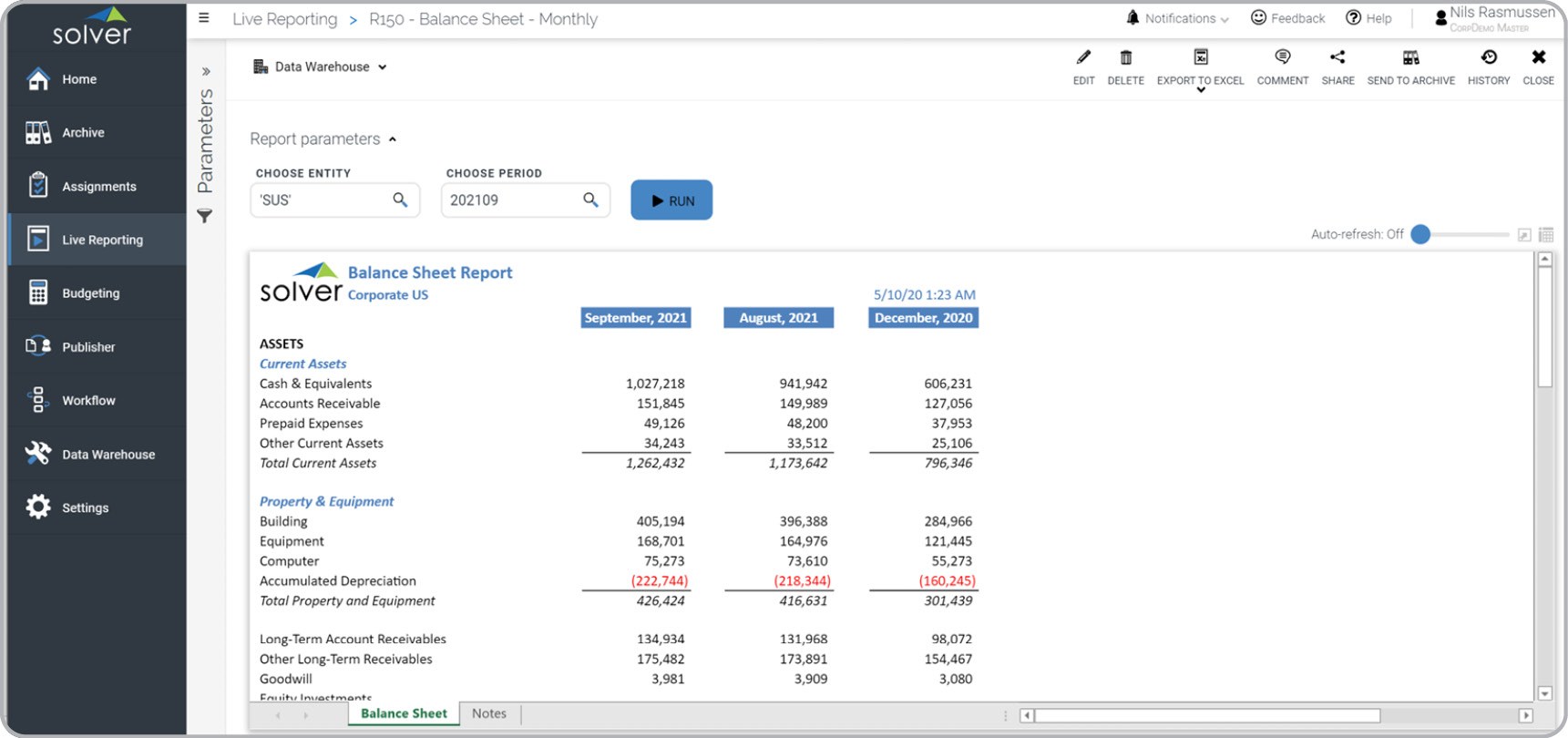

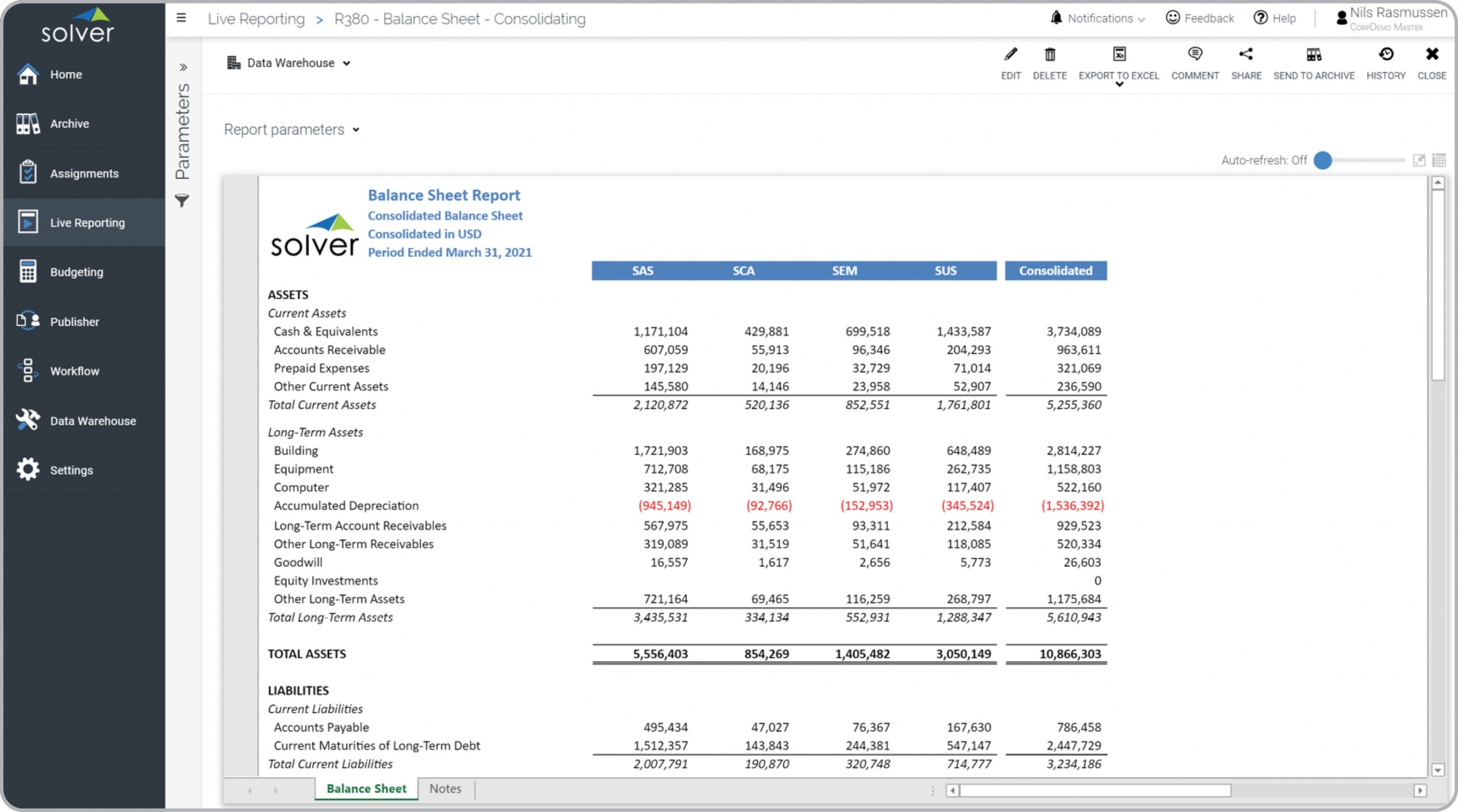

- Balance Sheet

- CEO

- COMPARE

- Driver-Based

- FDICIA

- FRx

- General Ledger

- IAS30

- Income statement forecast

- KPIs

- OLAP

- Payroll

- Profit and Loss

- SOX

- SaaS Forecast

- banks

- best practices

- best reporting tools for dynamics 365

- biznet

- budget software

- budgeting and forecasting

- cash flow

- corporate performance management tools

- cpm software companies

- credit union

- financial budgeting software

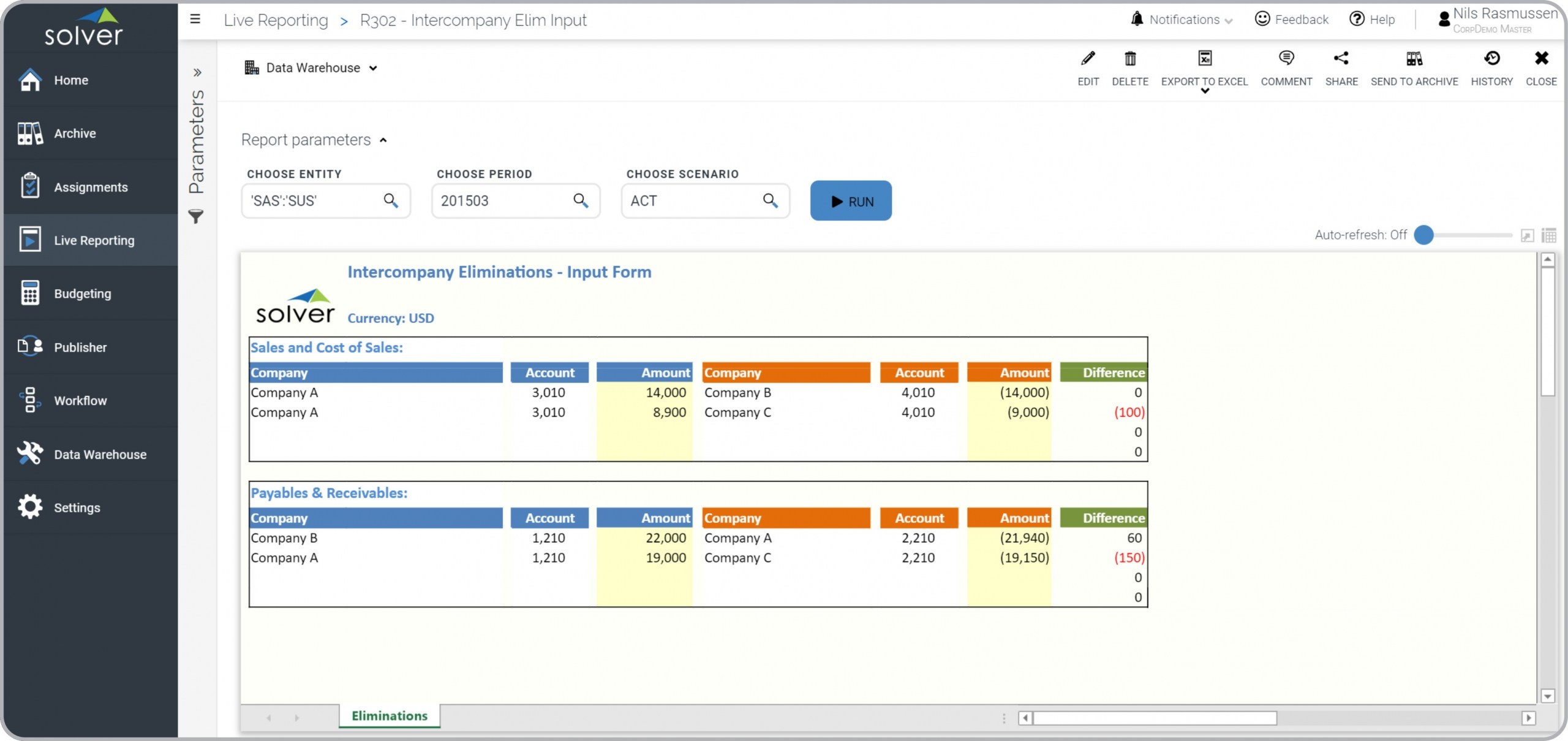

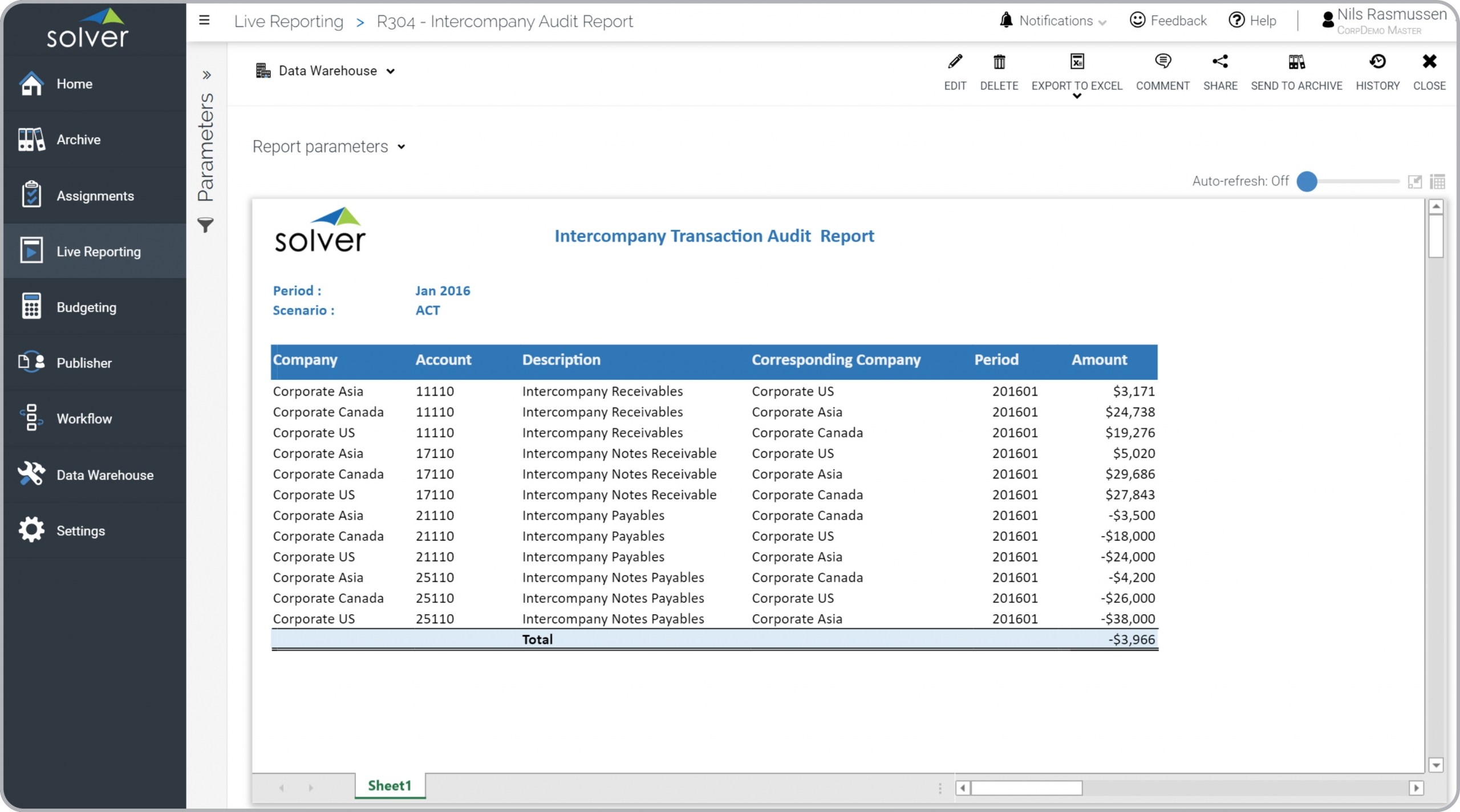

- intercompany

- processes

- Business Objects

- CAC

- CRM

- Centage

- Cloud-based

- Cognos TM1

- Crystal Reports

- DW

- Data Visualizations

- DeFacto

- ERP Partner Program (VAR)

- Excel budget

- FTE

- Financial Report Writing

- Forecaster

- IBM

- MR

- OLAP Cubes

- P&L forecast template

- SAP B1

- SAP Business One and tagged Adaptive Insights

- SaaS company forecast

- Tableau Software

- aging report

- analytics cloud

- best budgeting tools

- board international

- budget plan

- business planning

- chart

- cloud reporting

- co-sell

- collaboration

- consolidated

- cpm partners

- data integration

- decision maker

- department

- driver

- dynamic bucket

- financial close

- financial dashboard

- management platform

- monitoring and managing

- mrr

- process improvement

- profit & loss

- real time

- receivable

- reforecast

- revenue

- saas budget

- software vendors

- 12 month rolling forecast

- ARPA

- AWS

- AXUG

- Adaptive

- Amazon Web Services

- B1

- BPC

- BUDGETING TOOLS

- CFOs

- CLV dashboard

- Cloud Financial Reporting

- Customer Relationship Management

- Data Warehouses

- Domo

- Excel-based budgeting

- Excel-based reporting

- F9

- FORECASTING TOOLS

- HFM

- Key Performance Indicators

- MSDSLUG

- Maestro

- Microsoft Dynamics 365 Finance

- Microsoft Dynamics GP

- Microsoft Power BI

- Modeling

- Monthly Reporting

- NAVUG

- NIM

- NRR

- P&L forecast

- PL Report

- Personnel

- PowerBI

- QlikView

- SAP BPC

- SQL Server

- SaaS Income Statement

- SaaS KPI report

- Sage Budgeting and Planning.

- Scorecards

- Sub-ledger

- TOP FEATURES

- TechTarget

- Twelve Month Rolling Forecast Model

- Variance

- best budgeting software

- best forecasting software

- best report writers

- breakback

- budget templates

- business one

- bydesign

- capex budget

- cash contributions

- cash flow analysis

- challenges

- churn

- committed investment

- customer cohort

- customer count

- data

- due to

- equity

- expense

- expenses

- finance and operations

- financial report

- financial reports

- financial templates

- funding

- headcount

- investors

- key performance indicator

- liquidity

- margin

- matching consolidation

- maxio

- monthly recurring revenue

- multi-year

- nonprofit

- payroll budget

- planning best practices

- post money

- profit

- profit & loss report

- report templates

- report with variances

- reports

- revenue budget

- rolling P&L forecast

- saas sales budget

- sales forecast

- shareholders

- subscription budget

- subscription revenue report

- templates

- what-if

- what-if scenarios

- 12 month

- 12 month rolling

- 3 month forecast

- 5 year forecast

- AP

- ARPA dashboard

- ARR budget

- Accountants love excel

- Accounts Payable

- Accounts Receivable

- Acumatica dashboards

- Acumatica reporting

- Adaptive Planning

- Add-ons

- Automated Reports

- Average Revenue per Account Dashboard

- Azure Cloud Services

- BI Solutions

- BI360 Dashboards

- BI360 Planning

- BI360 Reporting

- BPM International

- BYOD

- Balance Sheet Variance Report

- Benefits of Cloud

- Best-of-Breed

- Billings and Revenue Dashboard

- Bizview

- Board

- Branch consolidation

- Branch reporting

- Budget Maestro

- Budget|budgeting|Cloud|dynamics|dynamics 365 finan

- Budget|forecast|Human Capital|Labor Pool|Manpower|

- Business Planning and Control

- CACo

- CCR

- CCR dashboard

- CLV

- Call reports

- Cancellations

- Cap Table Template

- Cash Flow Dashboard

- Churn Count Waterfall Report

- Cloud based financial reporting

- Cloud based reporting tools

- Cloud-based Reporting

- Collabera

- Compensation Dashboard

- Contract Funding

- Contract Length

- Creating Finance Reports

- Customer Acquisition Cost Analysis (CAC) Dashboar

- Customer Churn Rate Dashboard

- Customer Lifetime Value (CLV) Dashboard

- D365 FO

- Departmental salary cost dashboard

- Design

- Dynamics 365 FO

- Dynamics 365 reporting

- ERP Reporting

- ERP migration

- ETL

- Employee

- Enterprise Performance Management

- Enterprise Reporting

- Expense Dashboard with Trends and Variances

- Extraction

- FA

- FDIC

- FFIEC

- FINANCIAL REPORTING TOOLS

- FRB

- FRx replacement

- FTEs

- FTEs needed to meet sales budget

- Federal Financial Institutions Examination Council

- Federal Reserve

- Financial Consolidation Solutions

- Financial KPI Dashboard

- Financial Reporting and Analysis

- Financial Scenario Analysis

- Five Year Profit & Loss Forecast Template

- Fixed Assets

- Forecast Model

- Graphical Scorecards

- Gross Burn Rate

- Gross Margin Analysis Report

- Human Capital

- IFRS

- INSIGHT SOFTWARE

- Income Statement Budget

- Inventory

- Investopedia

- Jet Enterprise

- Jet Express

- LTV

- LTV TO CAC RATIO

- Labor Pool

- Lead Target to Meet Sales Goals Model

- Lifetime Value (LTV) to Customer Acquisition Cost

- Line of Credit

- Loan Analysis Model

- MEM

- MR replacement

- MRCAC

- MRR Churn

- MRR Downgrades

- MRR Existing Customers

- MRR KPI report

- MRR New Customers

- MRR Retention Waterfall Report

- MRR Upgrades

- MRR budget

- MRR dashboard

- MRR retention

- MRR waterfall

- Management Reporter Alternatives

- Manpower

- Microsoft Azure

- Microsoft BI Stack

- Microsoft Dynamics 365

- Microsoft Dynamics 365 Finance and Operations

- Microsoft Management Reporter

- Microsoft-based

- Mobile Reporting

- Monte Carlo analysis

- Monthly Recurring Revenue Dashboard

- Months to Recover CAC Dashboard

- Months to Recover CAC KPI

- Multi-Entity Management

- Multi-year Budgets

- Multiple charts of accounts

- NET BURN RATE

- NET REVENUE RETENTION

- NFP

- Net Burn Rate Dashboard

- Net Revenue Retention Dashboard

- New Subscriptions

- OLAP Cube

- OPEX Report

- OPEX dashboard

- Office of Thrift Supervision

- Operating Expense Analysis

- Operating Expense Dashboard

- P&L budget

- P&L budget template

- P&L dashboard

- PA

- PrecisionPoint

- Price Change Simulation Dashboard

- Productivity

- Profit & Loss Budget Template

- Profit & Loss Forecast Template

- Profit & Loss Interactive Report

- Profit & Loss Variance Report

- Profitability Dashboard with Trends and Variances

- Progressus

- Project Accounting

- Qlik

- Qlik Sense Desktop

- RDBMS

- ROI calculator

- ROI of CPM software

- ROI of budgeting software

- ROI tool

- Relational Management Database System

- Removals

- Renewed Subscriptions

- Renovofyi

- Replacing FRx

- Report Sharing

- Report of Condition and Income

- Reporting for Microsoft Dynamics GP

- Revenue Auto Forecast

- Revenue Mix Analysis Report

- Revenue Variance and Trend Dashboard

- Revenue and Profitability Benchmark Report

- Risk analysis

- Rolling 12 Month Cash Balance Report

- Rolling 12 Month MRR Trend Report

- Rolling 12 Month Trend Report

- Rolling Forecasts

- Royalty Model

- Rule of 40

- Rule of 40 KPI Report

- SAP B1 Reporting

- SAP Business One Reporting

- SAP HANA

- SAPB1

- SG&A

- SOP

- SQL Management Studio

- SQL Server Reporting Services

- SQL Server integration services

- SRSS

- SSIS

- SSMS

- SaaS Company Evaluation

- SaaS Evaluation Model Report

- SaaS cash flow

- SaaS company budget

- SaaS gross margin report

- SaaS revenue forecast

- SaaS sales forecast

- Sales Order Processing

- Sales Team Planning Model to Meet Budget Targets

- Salesforce

- Salesforce.com

- Scheduling Reports

- Software as a Service

- Sports

- Spreadsheet

- Strategic Plan

- Sub-ledger reports

- Subscription Billing Report

- Subscription Billings Forecast Template

- Subscription Discount Dashboard

- Subscription Revenue Budget Model

- Subscription Revenue and Deferrals Report

- Subscription Revenue by Order Type Report

- Subscription Sales by Contract Length Report

- TOP 10

- Term Loan

- Thrift Financial Report

- Total MRR

- Total Revenue

- Value Creation of Raising New Equity

- Web Reporting

- Web-based Reporting

- accuracy

- active customers

- adjustment

- advanced budgeting

- allocations

- alternative

- and Loading

- annual budget

- ascend

- aspects of demand planning

- aspects of demand planning|best corporate performa

- asset

- atlas xl

- audit

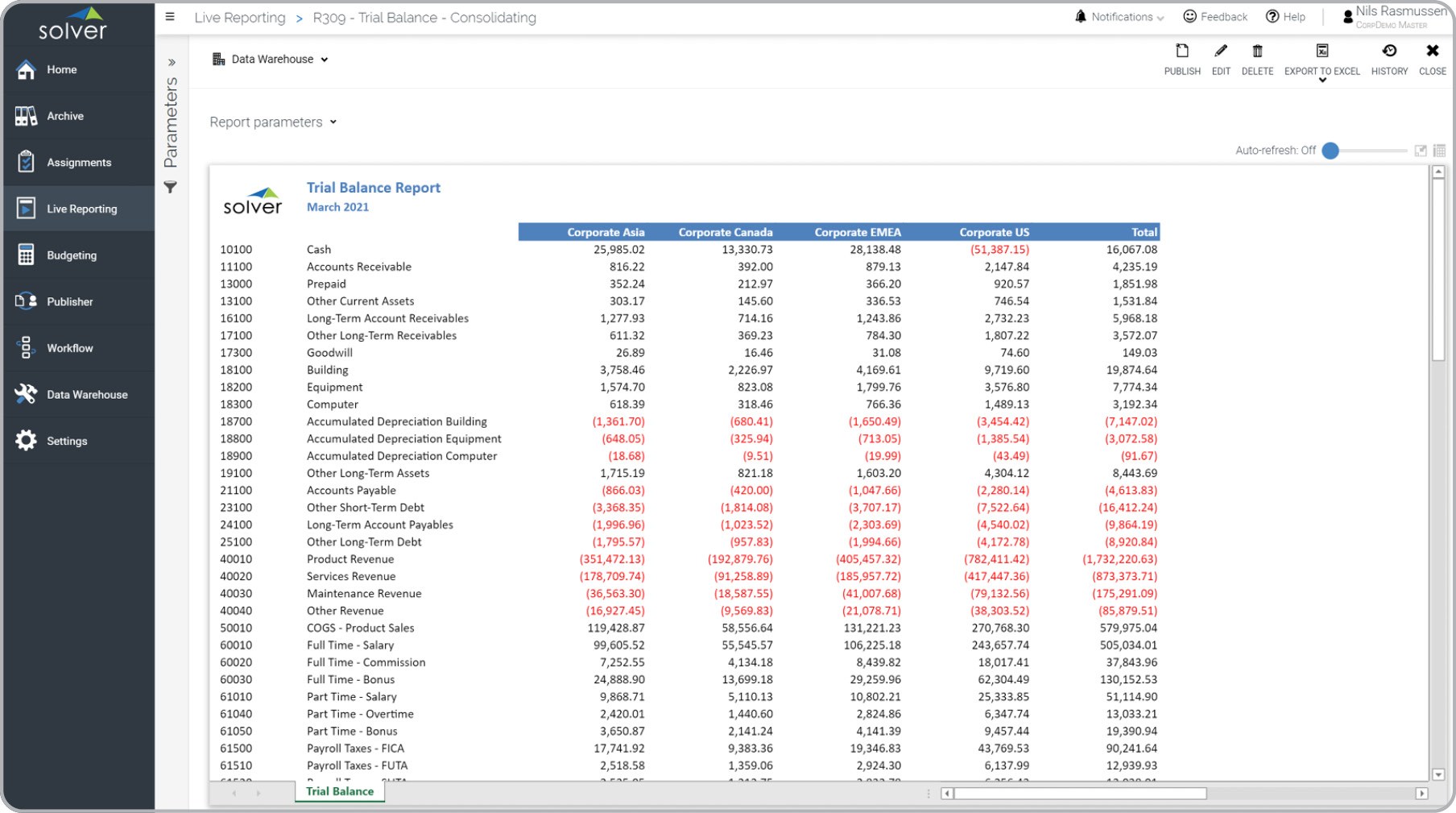

- automated footnotes

- automated reporting

- automated revenue forecast

- automated workflows

- azure data lake

- azure-based

- balance sheet monthly trend report

- benchmark

- benchmark report

- best consolidation software

- best cpm software

- best dashboard tools for Acumatica

- best dashboard tools for dynamics 365 finance

- best data warehouse

- best excel report writers

- best excel reporting tools

- best financial reporting software

- best planning tools for dynamics 365 finance

- best reporting software

- best reporting tools

- billing

- board members and executives

- bookings

- bs

- budgeting assignments

- budgeting best practices

- budgeting module

- budgeting pain

- budgeting process

- business edition

- capex

- capital

- cash balance trend report

- cash dashboard

- cash flow forecast

- cash flow report

- cash flow waterfall

- category

- charts

- check list

- churned customers

- cloud-based cpm solutions

- cogs

- compensation cost benchmark

- connector

- consolidate

- consolidating

- consolidation budgeting

- consulting

- coronavirus

- covid19

- cpm database

- cpm tool

- cpm vendor comparison

- customer acquisition cost

- customer churn

- customer count report

- customer lifetime value

- d365 business central

- data storage

- data store

- data tables

- data warehose

- database

- datashelf

- deferred revenue report

- deferred subscription revenue

- demand planning

- department managers and FP&A

- departments

- deployment

- development

- digital

- discount

- discount analysis

- discount by product

- discount by sales person

- donors

- drill down reports

- driver-based forecast

- drivers

- ebitda

- elimination

- eliminations

- end

- entry

- excel financial reporting

- excel-based reporting tools

- executive SAAS KPI dashboard

- executive financial dashboard

- faster and better decisions

- faster decisions

- finance & operations

- financial data warehouse

- financial report for SaaS

- financial scenario modeling

- financial scenario modeling best practices

- financial scenario planning

- financing

- flash report

- forecaster replacement

- forecasting methods

- forecasting process

- free ROI calculator

- fulfilled by acumatica

- goals

- grants

- graphical P&L

- graphs

- gross margin

- gross margin dashboard for SaaS

- halo

- higher ed

- higher education

- hr

- human capital dashboard

- human resources

- income statement for SaaS

- intacct integration

- intragroup

- last year

- lead calculator

- lead model

- live reporting

- long range

- management reporter replacement

- managment reporter

- marketing budget

- matching

- metrics

- migrating

- month end close

- months

- multi-year P&L forecast

- multiyear

- narrative

- net profit

- new customers

- non-profit

- not-for-profit

- online analytical processing

- operational reporting

- organization

- payroll cost by department

- personal KPIs

- pipeline

- pre and post funding

- pre-built connector

- preferred app

- price

- price change

- price increase analysis

- pricing simulation

- prior month

- professional sports

- profit & loss forecast

- profit margin

- profitability benchmark

- project

- project budget

- quantity

- random factor analysis

- real-time reporting

- reconciliation

- renewal forecast

- renewed customers

- renovo FYI

- replacing

- report designer

- reporting & analysis

- reporting and consolidation processes

- return on investment

- revenue analysis

- revenue benchmark

- revenue estimate

- revenue growth

- revenue mix

- revenue mix dashboard

- revenue trend report

- revenues

- roi of cpm

- rolling

- rolling cash flow report

- rolling trend

- root cause

- saas payroll cost

- saas revenue budget

- sales budget

- sales dashboard

- sales funnel model

- sales team planning

- scenario

- services

- strategic

- strategy

- subscription billing by customer

- subscription billing by item

- subscription forecast

- subscription recognized revenue

- subscription revenue dashboard

- subscription sales

- subscription sales report

- talent

- targit

- top-down forecast

- value of saas company

- visualization

- waterfall