Revenue Budget Review and Adjustment Model for Public Sector Organizations

What is a

Revenue Budget Review and Adjustment model

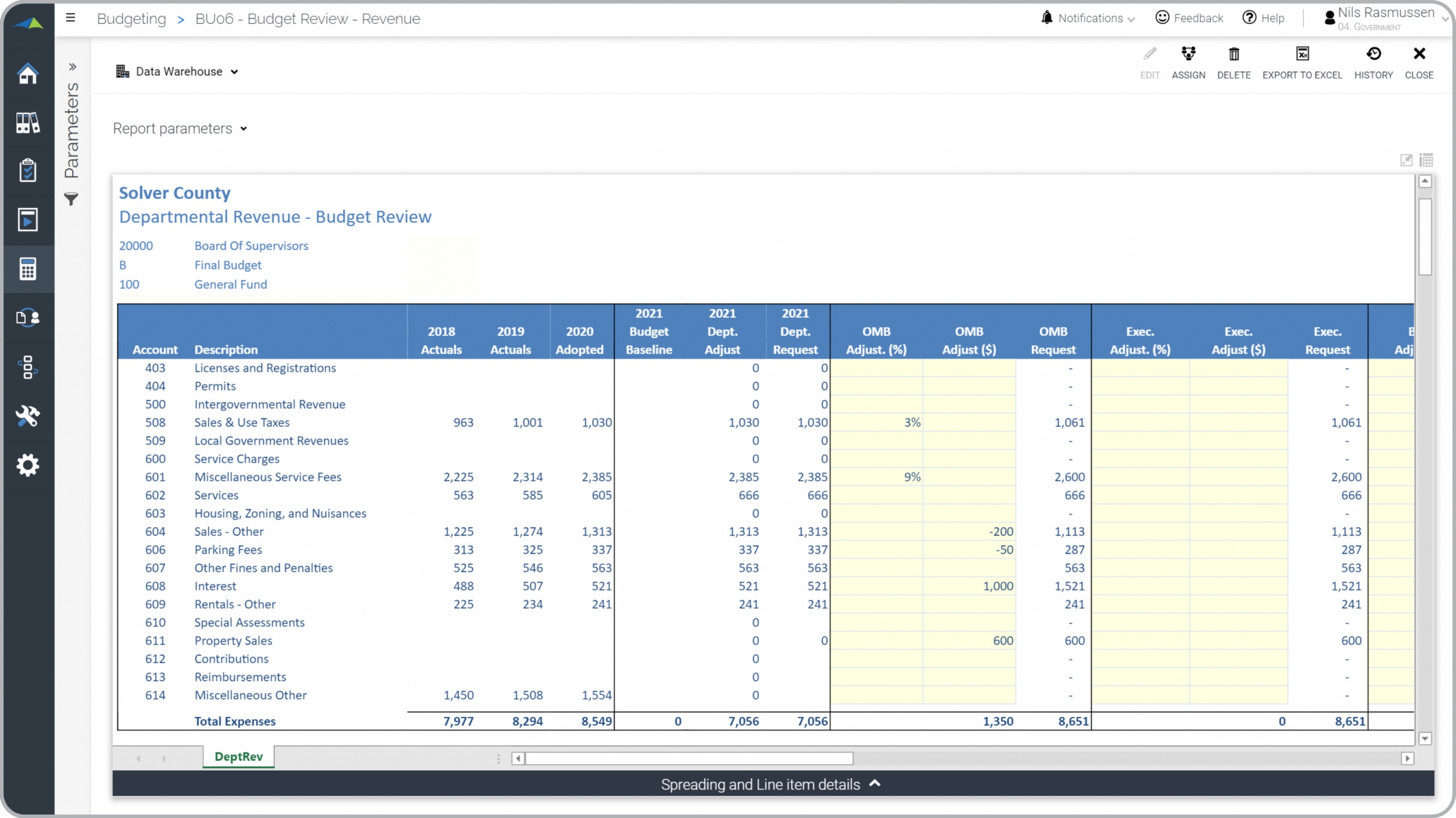

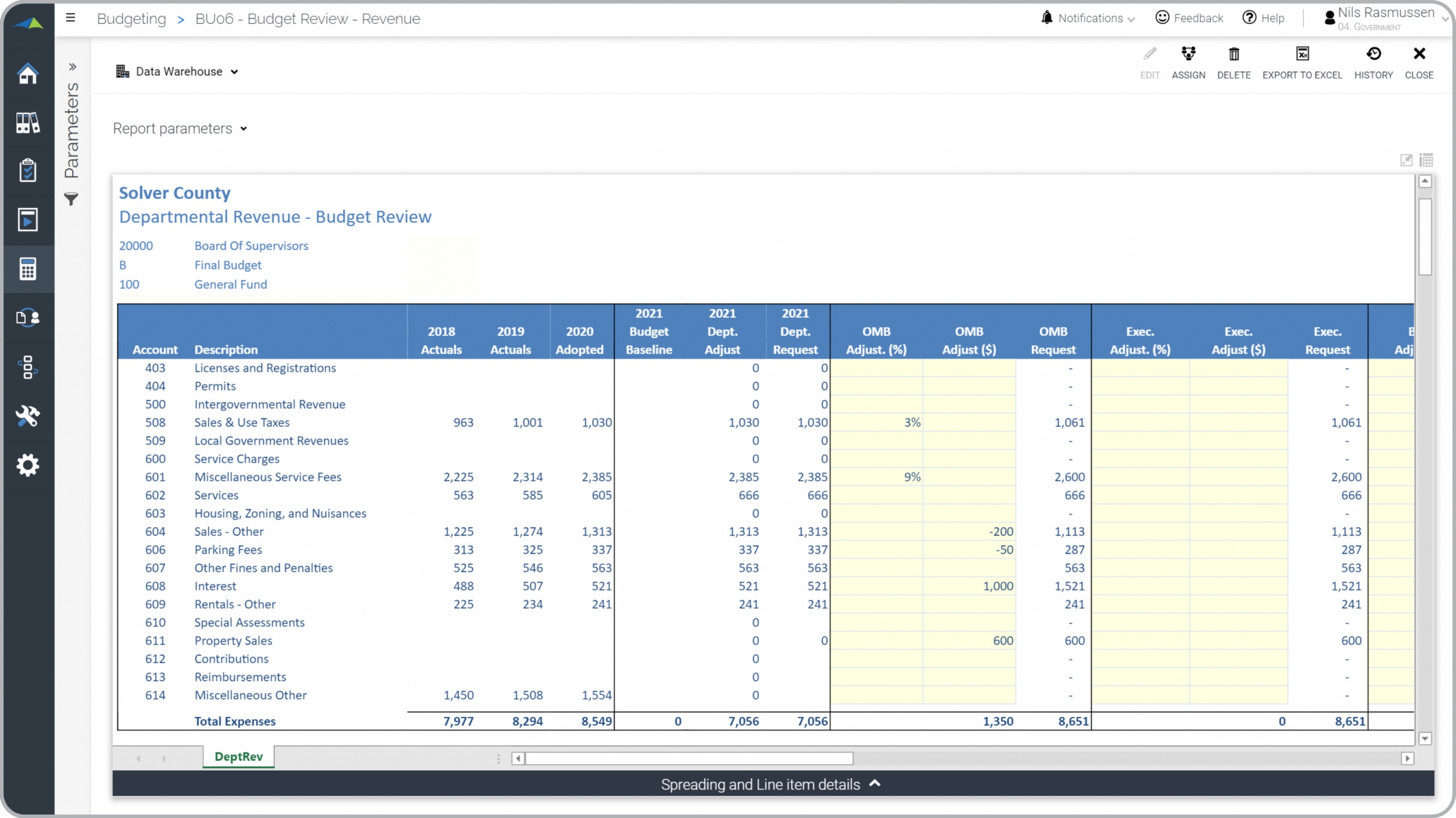

? Revenue Budget Review and Adjustment input forms are considered a key part of annual budget models used as a best practice by government entities. These templates used by budget managers and reviewers to review budget requests along with historical data and to enter proposed adjustments. Some of the main functionality in this type of budget template is that it displays historical actual and budget data and provides input of proposed increases/decreases with commentary. The example below has the following information: 1) Two years of actual data, 2) Last year's adopted budget, 3) Baseline budget (can be a copy of last year's adopted budget) and departmental adjustments which is added up to departments' requested budget for the current budget process, 4) Amount and/or percent adjustments by the Budget Manager's Office, 5) Adjustments from the Executive office, and 6) Adjustments from the Board. Not visible in the screenshot are also comment input fields for each of the reviewers. You find an example of this budget template below.

Purpose of

Budget Review and Adjustment Models Public Sector organizations use Budget Review and Adjustment Models to enable a highly structured budget process with automated documentation and workflow. When used as part of good business practices in Budgeting and Planning departments, a government entity can improve its revenue budget accuracy, and it can reduce the chances that comments and adjustments are poorly communicated or lost during the budget process.

Example of a

Budget Review and Adjustment Model Here is an example of a Revenue Review and Adjustment input form with automatically displayed historical data and input of text comments. [caption id="" align="alignnone" width="2560"]

Example of a Revenue Budget Review and Adjustment model for Public Sector Organizations[/caption] You can find hundreds of additional examples

here

Who Uses This Type of

Budget template

? The typical users of this type of budget template are: Executives, Budget Managers, department heads.

Other Reports Often Used in Conjunction with

Budget Review and Adjustment Models Progressive Budgeting and Planning departments sometimes use several different Budget Review and Adjustment Models, along with general ledger and line items expense input forms, employee (human capital) and headcount forms, capital budget forms, budget analysis dashboards and other management and control tools.

Where Does the Data for Analysis Originate From? The Actual (historical transactions) data typically comes from enterprise resource planning (ERP) systems like: Microsoft Dynamics 365 (D365) Finance, Microsoft Dynamics 365 Business Central (D365 BC), Microsoft Dynamics AX, Microsoft Dynamics NAV, Microsoft Dynamics GP, Microsoft Dynamics SL, Sage Intacct, Sage 100, Sage 300, Sage 500, Sage X3, SAP Business One, SAP ByDesign, Acumatica, Netsuite and others. In analyses where budgets or forecasts are used, the planning data most often originates from in-house Excel spreadsheet models or from professional corporate performance management (CPM/EPM) solutions.

What Tools are Typically used for Reporting, Planning and Dashboards? Examples of business software used with the data and ERPs mentioned above are:

Example of a Revenue Budget Review and Adjustment model for Public Sector Organizations[/caption] You can find hundreds of additional examples

here

Who Uses This Type of

Budget template

? The typical users of this type of budget template are: Executives, Budget Managers, department heads.

Other Reports Often Used in Conjunction with

Budget Review and Adjustment Models Progressive Budgeting and Planning departments sometimes use several different Budget Review and Adjustment Models, along with general ledger and line items expense input forms, employee (human capital) and headcount forms, capital budget forms, budget analysis dashboards and other management and control tools.

Where Does the Data for Analysis Originate From? The Actual (historical transactions) data typically comes from enterprise resource planning (ERP) systems like: Microsoft Dynamics 365 (D365) Finance, Microsoft Dynamics 365 Business Central (D365 BC), Microsoft Dynamics AX, Microsoft Dynamics NAV, Microsoft Dynamics GP, Microsoft Dynamics SL, Sage Intacct, Sage 100, Sage 300, Sage 500, Sage X3, SAP Business One, SAP ByDesign, Acumatica, Netsuite and others. In analyses where budgets or forecasts are used, the planning data most often originates from in-house Excel spreadsheet models or from professional corporate performance management (CPM/EPM) solutions.

What Tools are Typically used for Reporting, Planning and Dashboards? Examples of business software used with the data and ERPs mentioned above are:

- Native ERP report writers and query tools

- Spreadsheets (for example Microsoft Excel)

- Corporate Performance Management (CPM) tools (for example Solver)

- Dashboards (for example Microsoft Power BI and Tableau)

Corporate Performance Management (CPM) Cloud Solutions and More Examples

July 3, 2021

TAGS:

Reporting,

Solver,

local,

report writer,

Microsoft,

template,

practice,

Acumatica,

Netsuite,

Finance,

public,

planning,

GP,

Government,

Business Central,

state,

excel,

ax,

forecast,

Budget,

Dynamics 365,

budgeting,

revenue,

Cloud,

Software,

Tableau,

SAP,

example,

best,

Sage,

BC,

D365,

fund,

NAV,

Intacct,

county,

city,

CPM,

report,

sector,

SL,

Management,

dynamics,

Power BI,

plan,

review,

approval,

budget adjustments,

revenue budget