Non-commissioned Staff Payroll Budget for Retail Companies

What is

a

Non-commissioned Staff Payroll Budget

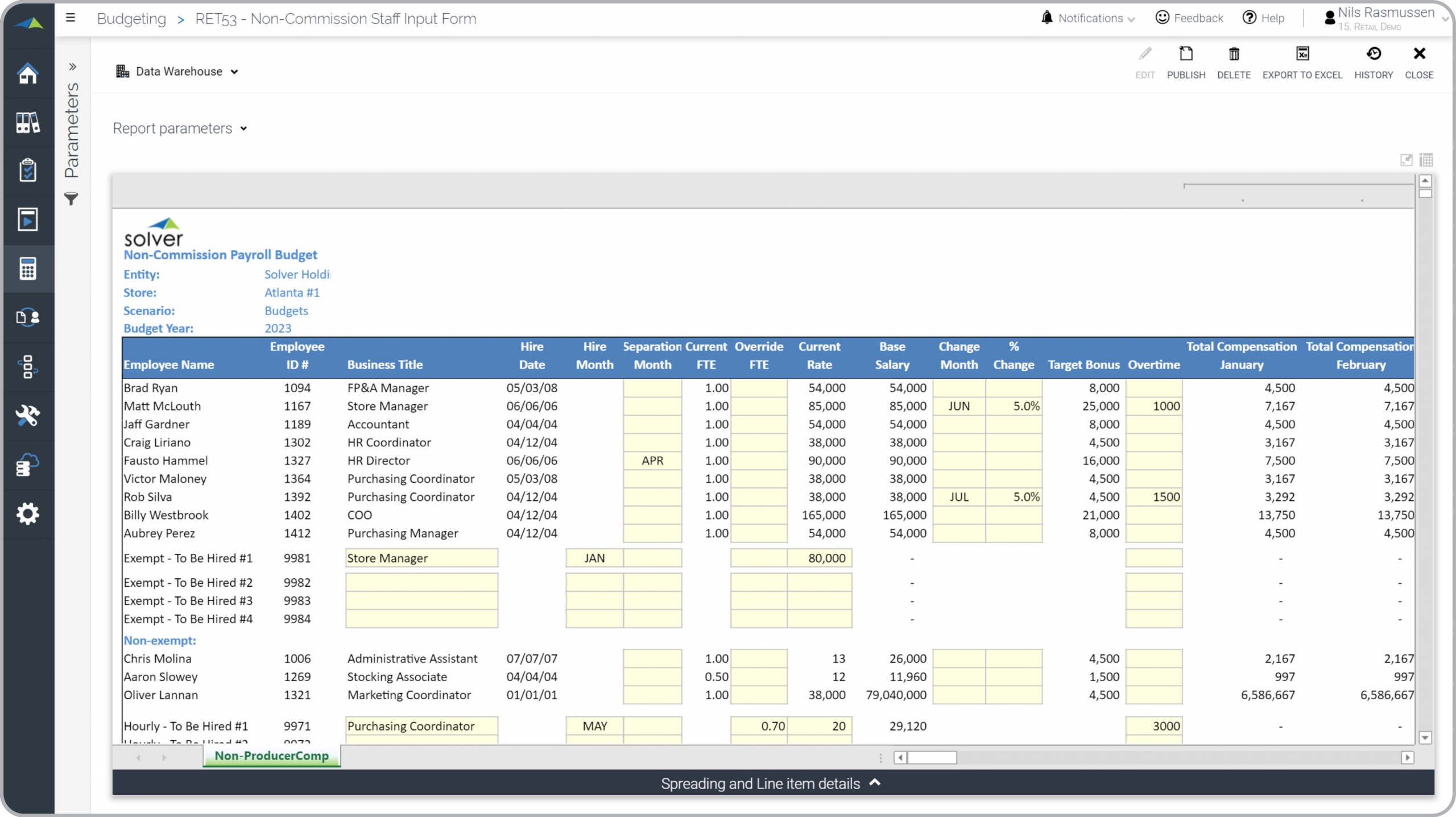

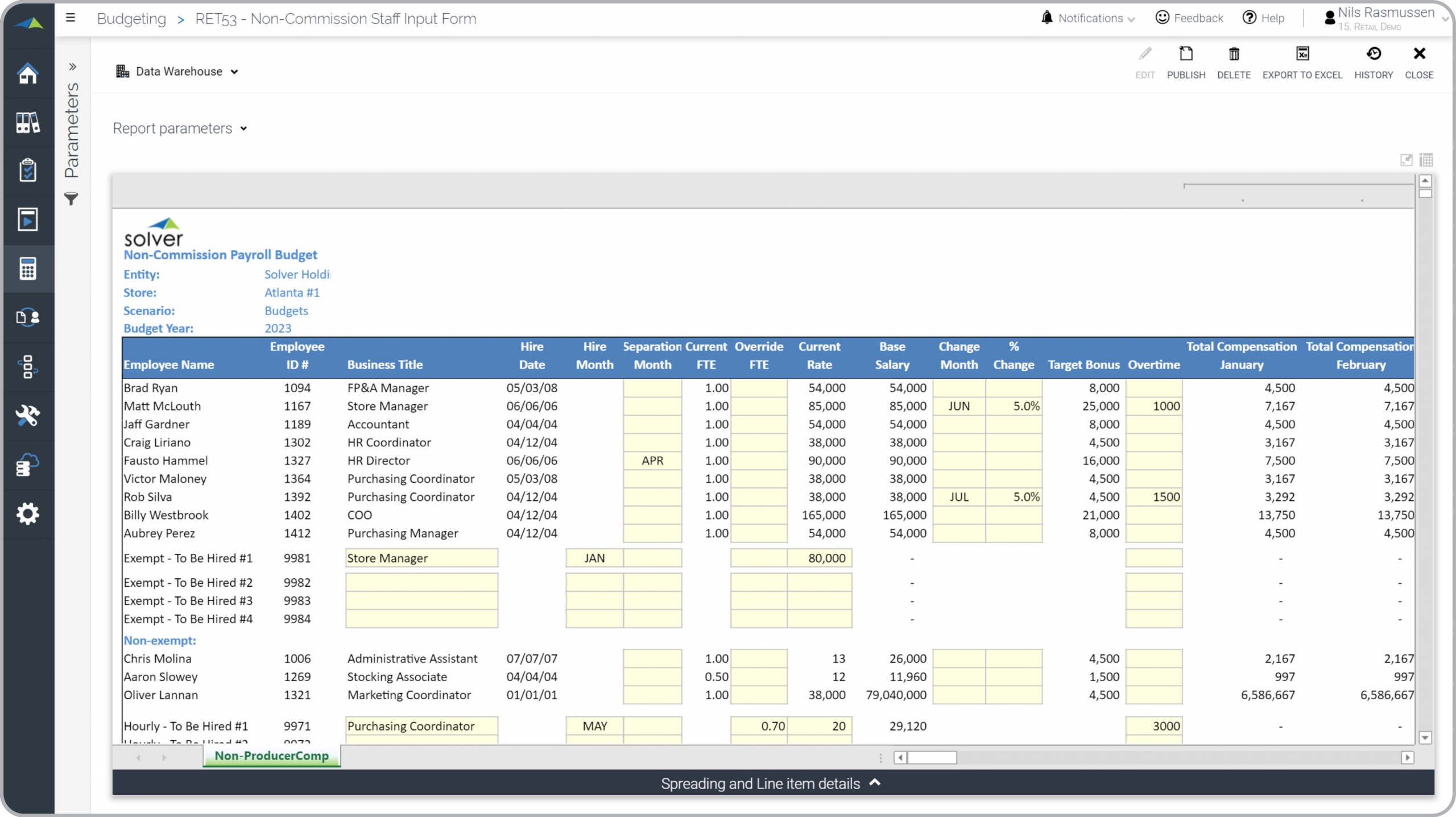

? Non-commissioned Staff budget forms are considered employee payroll planning templates and are often used by retail chains and store managers to plan all the details related to compensation budgets for non-commissioned salaried employees. Key functionality in this type of model captures all the details of a retail staff budget. This includes hire/termination dates, full time employee (FTE) count, salary and increases, bonuses, taxes and benefits. It has separate sections for exempt and non-exempt employees. At the bottom of the form, the manager can enter information for new hires. You will find an example of this type of model below.

Purpose of

Non-commissioned Staff Budget Forms Retail companies use Non-commissioned Staff Budget Forms to make it easy for regional or store managers to capture detailed employee budgets. When used as part of good business practices in a Financial Planning & Analysis (FP&A) department, a company can improve its budget accuracy and future staffing plans, as well as, reduce the chances that performance of a retail location is affected by poor planning.

Non-commissioned Staff Budget Form

Example Here is an example of detailed budget input form for Non-commissioned Staff Members in a retail organization. [caption id="" align="alignnone" width="2560"]

Non-commissioned Staff Payroll Budget for Retail Companies Example[/caption] You can find hundreds of additional examples

here.

Who Uses This Type of

Model

? The typical users of this type of model are: Store managers, regional managers, HR managers, CFOs, budget managers.

Other

Model

s Often Used in Conjunction with

Non-commissioned Staff Budget Forms Progressive Financial Planning & Analysis (FP&A) Departments sometimes use several different Non-commissioned Staff Budget Forms, along with sales and other operating expense budgets, capex, cash flow plans and other management and control tools.

Where Does the Data for Analysis Originate From? The Actual (historical transactions) data typically comes from enterprise resource planning (ERP) systems like: Microsoft Dynamics 365 (D365) Finance, Microsoft Dynamics 365 Business Central (D365 BC), Microsoft Dynamics AX, Microsoft Dynamics NAV, Microsoft Dynamics GP, Microsoft Dynamics SL, Sage Intacct, Sage 100, Sage 300, Sage 500, Sage X3, SAP Business One, SAP ByDesign, Acumatica, Netsuite and others. In analyses where budgets or forecasts are used, the planning data most often originates from in-house Excel spreadsheet models or from professional corporate performance management (CPM/EPM) solutions.

What Tools are Typically used for Reporting, Planning and Dashboards? Examples of business software used with the data and ERPs mentioned above are:

Non-commissioned Staff Payroll Budget for Retail Companies Example[/caption] You can find hundreds of additional examples

here.

Who Uses This Type of

Model

? The typical users of this type of model are: Store managers, regional managers, HR managers, CFOs, budget managers.

Other

Model

s Often Used in Conjunction with

Non-commissioned Staff Budget Forms Progressive Financial Planning & Analysis (FP&A) Departments sometimes use several different Non-commissioned Staff Budget Forms, along with sales and other operating expense budgets, capex, cash flow plans and other management and control tools.

Where Does the Data for Analysis Originate From? The Actual (historical transactions) data typically comes from enterprise resource planning (ERP) systems like: Microsoft Dynamics 365 (D365) Finance, Microsoft Dynamics 365 Business Central (D365 BC), Microsoft Dynamics AX, Microsoft Dynamics NAV, Microsoft Dynamics GP, Microsoft Dynamics SL, Sage Intacct, Sage 100, Sage 300, Sage 500, Sage X3, SAP Business One, SAP ByDesign, Acumatica, Netsuite and others. In analyses where budgets or forecasts are used, the planning data most often originates from in-house Excel spreadsheet models or from professional corporate performance management (CPM/EPM) solutions.

What Tools are Typically used for Reporting, Planning and Dashboards? Examples of business software used with the data and ERPs mentioned above are:

- Native ERP report writers and query tools

- Spreadsheets (for example Microsoft Excel)

- Corporate Performance Management (CPM) tools (for example Solver)

- Dashboards (for example Microsoft Power BI and Tableau)

Corporate Performance Management (CPM) Cloud Solutions and More Examples

September 14, 2020

TAGS:

Reporting,

Solver,

report writer,

Microsoft,

consolidation,

Payroll,

template,

staff,

practice,

Acumatica,

Netsuite,

Finance,

planning,

GP,

Business Central,

hr,

excel,

ax,

forecast,

Budget,

forecasting,

Employee,

budgeting,

modelling,

Cloud,

Software,

Tableau,

SAP,

compensation,

example,

best,

Sage,

BC,

store,

D365,

NAV,

Intacct,

chain,

Retail,

salary,

CPM,

report,

SL,

Management,

dynamics,

Power BI,

non-commission