Expenditure by Fund Budget Report for Public Sector Organizations

What is a

Expenditure by Fund Budget Report

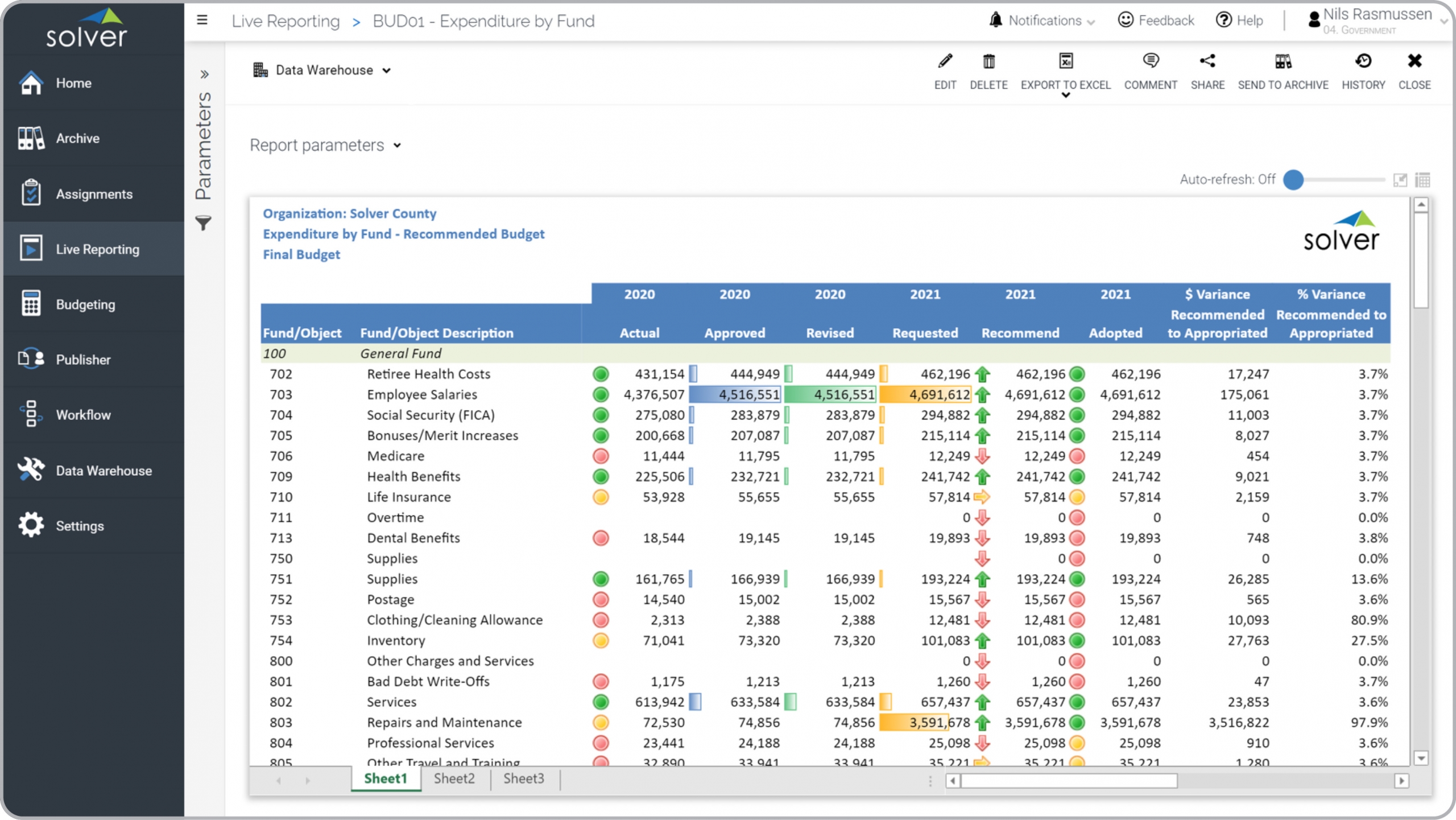

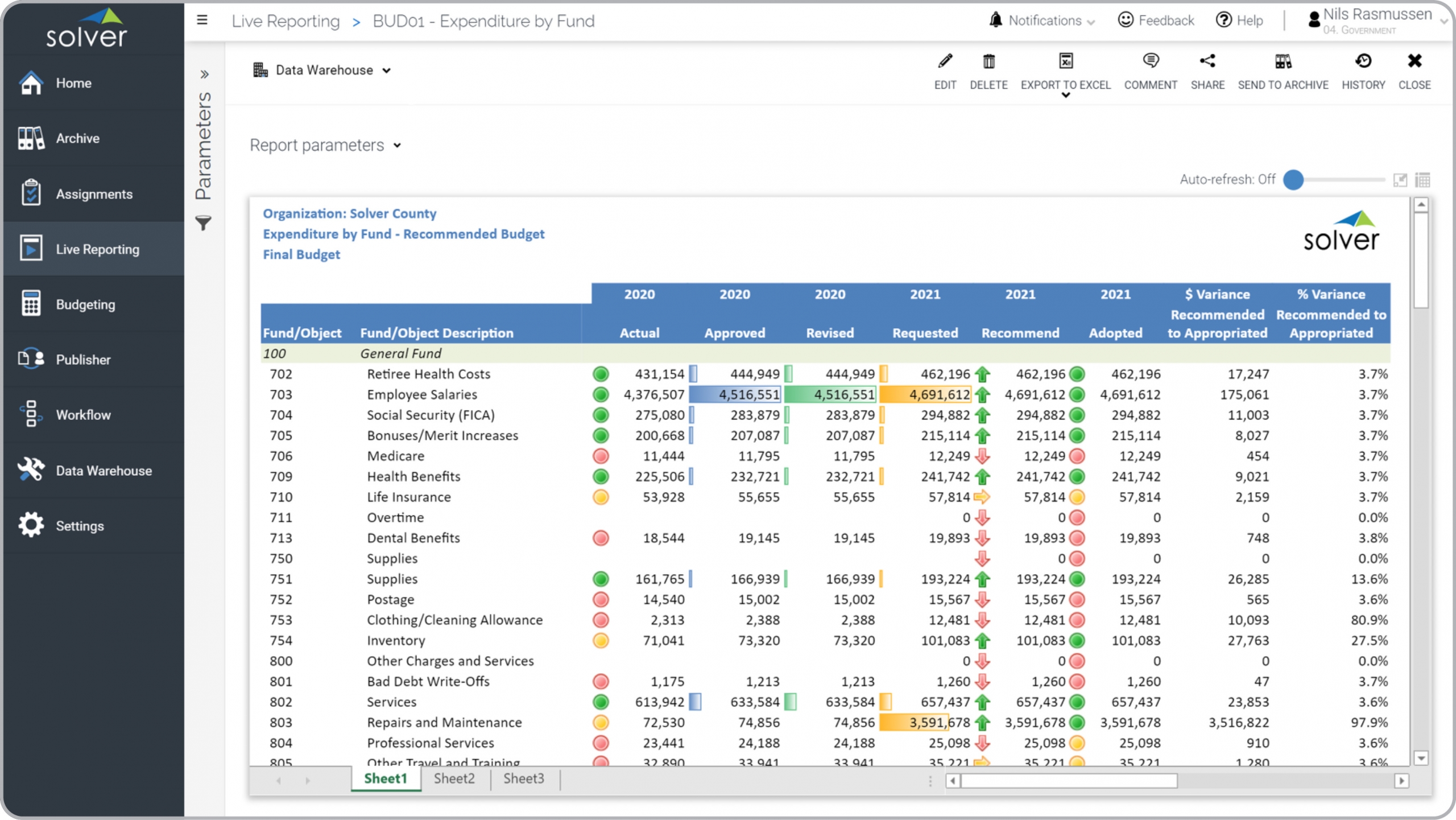

? Expenditure by Fund Budget Reports are considered budget approval and analysis tools and are used by Executives and Budget Managers to review approved expense budgets by fund. Some of the main functionality in this type of report is that it shows historical results as well as the iterations of the current budget. Information include: 1) Prior year actual expenses by fund, 2) Prior year approved budget, 3) Prior year revised budget, 4) Requested budget, 5) Recommended budget, 6) Adopted budget, 7) Variances in amounts and percent. The rows groups and sub-totals expenses by account (object code) and fund. The traffic lights help highlight significant amounts. You find an example of this type of report below.

Purpose of

Expenditure by Fund Budget Reports Public Sector organizations use Expenditure by Fund Budget Reports to give leaders a clear picture of how they arrived at the adopted budget. When used as part of good business practices in Planning and Executive departments, a government entity can improve its strategic decisions and expense allocations, and it can reduce the chances that managers lack ownership and oversight into fund budgets.

Example of a

Expenditure by Fund Budget Report Here is an example of an Expenditures by Fund Report with account-level detail by fund as well as detailed budget versions. [caption id="" align="alignnone" width="2560"]

Example of an Expenditure by Fund Budget Report for Public Sector Organizations[/caption] You can find hundreds of additional examples

here

Who Uses This Type of

Report

? The typical users of this type of report are: Executives, strategic planners, budget officers, controllers.

Other Reports Often Used in Conjunction with

Expenditure by Fund Budget Reports Progressive Planning and Executive departments sometimes use several different Expenditure by Fund Budget Reports, along with financial budget dashboards, strategic plans, annual budgets, financial statements, government KPI dashboards and other management and control tools.

Where Does the Data for Analysis Originate From? The Actual (historical transactions) data typically comes from enterprise resource planning (ERP) systems like: Microsoft Dynamics 365 (D365) Finance, Microsoft Dynamics 365 Business Central (D365 BC), Microsoft Dynamics AX, Microsoft Dynamics NAV, Microsoft Dynamics GP, Microsoft Dynamics SL, Sage Intacct, Sage 100, Sage 300, Sage 500, Sage X3, SAP Business One, SAP ByDesign, Acumatica, Netsuite and others. In analyses where budgets or forecasts are used, the planning data most often originates from in-house Excel spreadsheet models or from professional corporate performance management (CPM/EPM) solutions.

What Tools are Typically used for Reporting, Planning and Dashboards? Examples of business software used with the data and ERPs mentioned above are:

Example of an Expenditure by Fund Budget Report for Public Sector Organizations[/caption] You can find hundreds of additional examples

here

Who Uses This Type of

Report

? The typical users of this type of report are: Executives, strategic planners, budget officers, controllers.

Other Reports Often Used in Conjunction with

Expenditure by Fund Budget Reports Progressive Planning and Executive departments sometimes use several different Expenditure by Fund Budget Reports, along with financial budget dashboards, strategic plans, annual budgets, financial statements, government KPI dashboards and other management and control tools.

Where Does the Data for Analysis Originate From? The Actual (historical transactions) data typically comes from enterprise resource planning (ERP) systems like: Microsoft Dynamics 365 (D365) Finance, Microsoft Dynamics 365 Business Central (D365 BC), Microsoft Dynamics AX, Microsoft Dynamics NAV, Microsoft Dynamics GP, Microsoft Dynamics SL, Sage Intacct, Sage 100, Sage 300, Sage 500, Sage X3, SAP Business One, SAP ByDesign, Acumatica, Netsuite and others. In analyses where budgets or forecasts are used, the planning data most often originates from in-house Excel spreadsheet models or from professional corporate performance management (CPM/EPM) solutions.

What Tools are Typically used for Reporting, Planning and Dashboards? Examples of business software used with the data and ERPs mentioned above are:

- Native ERP report writers and query tools

- Spreadsheets (for example Microsoft Excel)

- Corporate Performance Management (CPM) tools (for example Solver)

- Dashboards (for example Microsoft Power BI and Tableau)

Corporate Performance Management (CPM) Cloud Solutions and More Examples

July 8, 2021

TAGS:

Reporting,

Solver,

local,

report writer,

Microsoft,

template,

practice,

Acumatica,

Netsuite,

Finance,

public,

comparison,

planning,

GP,

Government,

Business Central,

state,

excel,

ax,

budget variance,

forecast,

Budget,

Dynamics 365,

budgeting,

Cloud,

Software,

adopted,

Tableau,

SAP,

example,

best,

Sage,

BC,

D365,

fund,

NAV,

Intacct,

monthly,

county,

city,

CPM,

report,

sector,

SL,

Management,

dynamics,

Power BI,

budgeted expense by fund,

expenditure,

approved budget