Using Revenue Variance Dashboards to Streamline the Monthly Analysis Process

How can

Financial Dashboard

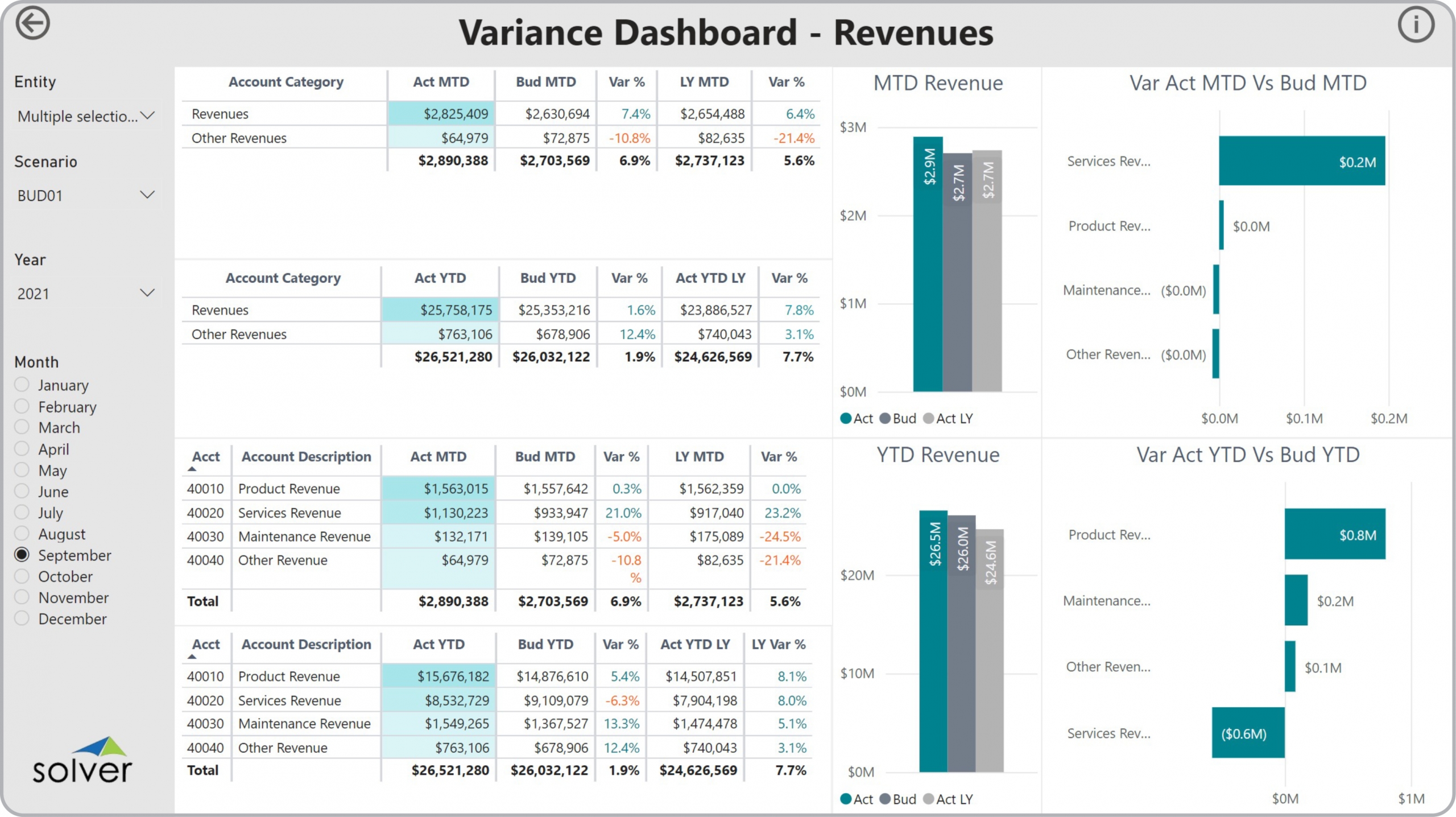

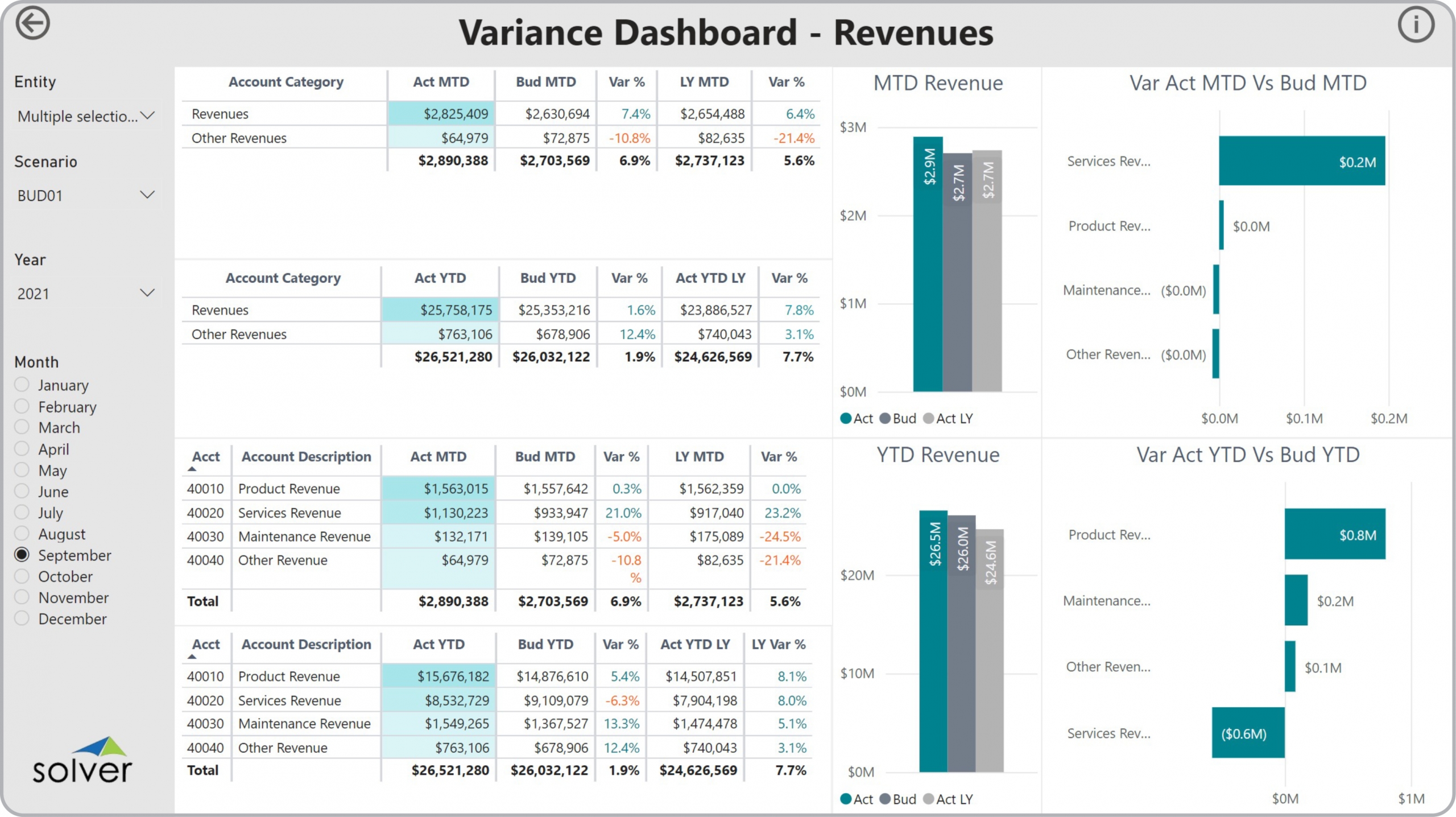

s Drive Faster and Better Decisions? As CFOs increasingly become key players in the Monthly Analysis Process, they must rely on modern self-service corporate performance management (CPM) and business intelligence (BI) tools. Using interactive Financial Dashboards like the Revenue Variance Dashboard template shown below enables them and users from the management team to experience near real time revenue metrics that help drive faster and better decisions.

Who uses

Revenue Variance Dashboard

s and What are Some Key Analytical Features? In today’s fast-paced business environment, CFOs are under high pressure to supply end users like board members and executives with timely and concise Financial Dashboards. Companies use key features like the ones below to support their users with effective analysis that helps drive revenue growth.

- Monthly and year-to-date revenue variances

- Budget and last year comparisons

- Interactive ranking

The Revenue Variance Dashboard template can be used as a key element of the Monthly Analysis process: [caption id="" align="alignnone" width="2560"]

Example of a Revenue Variance Dashboard to Streamline the Monthly Analysis Process[/caption] The Revenue Variance Dashboard is a ready-to-use Financial Dashboard from the

Solver Marketplace

A Brief Description of the

Revenue Variance Dashboard

Template Financial Dashboards like the one seen in the image above are interactive and parameter driven and typically contain sections with period filters, as well as revenue tables and charts. One of the important features that aid the user in the analysis process is the ability to click on a revenue row in any of the tables and see the related content automatically filtered and highlighted. Revenue Variance Dashboards are often used in conjunction with revenue trend and exception dashboards.

Data Integration to Transaction Systems Most organizations these days want automated and streamlined

planning,

reporting and

analysis. However, many of the benefits described earlier rely on best of breed Corporate Performance Management (CPM) tools and/or Business Intelligence (BI) capabilities as well as data marts or data warehouses that use pre-built integrations to the organization’s ERP system. Oftentimes, they also need integrations to other key data sources like CRM, subscription systems, payroll tools, etc. Modern, cloud-based ERPs like Microsoft Dynamics 365 Finance (D365 Finance), Microsoft Dynamics 365 Business Central (D365 BC), Sage Intacct, Acumatica, Netsuite and SAP have robust APIs which allow for dynamic integrations to CPM and BI tools that are fully automated and flexible to run on a schedule or on-demand.

Additional Resources to Aid with Research of Templates, CPM and BI Tools

Example of a Revenue Variance Dashboard to Streamline the Monthly Analysis Process[/caption] The Revenue Variance Dashboard is a ready-to-use Financial Dashboard from the

Solver Marketplace

A Brief Description of the

Revenue Variance Dashboard

Template Financial Dashboards like the one seen in the image above are interactive and parameter driven and typically contain sections with period filters, as well as revenue tables and charts. One of the important features that aid the user in the analysis process is the ability to click on a revenue row in any of the tables and see the related content automatically filtered and highlighted. Revenue Variance Dashboards are often used in conjunction with revenue trend and exception dashboards.

Data Integration to Transaction Systems Most organizations these days want automated and streamlined

planning,

reporting and

analysis. However, many of the benefits described earlier rely on best of breed Corporate Performance Management (CPM) tools and/or Business Intelligence (BI) capabilities as well as data marts or data warehouses that use pre-built integrations to the organization’s ERP system. Oftentimes, they also need integrations to other key data sources like CRM, subscription systems, payroll tools, etc. Modern, cloud-based ERPs like Microsoft Dynamics 365 Finance (D365 Finance), Microsoft Dynamics 365 Business Central (D365 BC), Sage Intacct, Acumatica, Netsuite and SAP have robust APIs which allow for dynamic integrations to CPM and BI tools that are fully automated and flexible to run on a schedule or on-demand.

Additional Resources to Aid with Research of Templates, CPM and BI Tools

- Templates from Solver that are pre-built and that work out-of-the-box using the Solver CPM cloud. Click here.

- Template examples: You find more than 500 CPM and BI Template examples here.

- Interactive Dashboard examples: Try Power BI dashboard templates from Solver here.

- Software evaluation and selection:

- Creating efficient processes:

November 13, 2021

TAGS:

Solver,

Microsoft,

Acumatica,

Netsuite,

D365 BC,

GP,

dashboard,

QuickStart,

report templates,

CFOs,

category,

ax,

Microsoft Dynamics,

Dynamics 365,

Dynamics 365 Business Central,

board members and executives,

Sage Intacct,

General Ledger,

dashboard templates,

KPI,

budget templates,

Oracle,

dynamics 365 finance,

SAP,

templates,

Monthly Analysis,

Sage,

business one,

financial templates,

D365,

revenues,

NAV,

Intacct,

monthly,

BI,

Variance,

financial dashboard,

GL,

chart,

CPM,

SL,

dynamics,

EPM,

Revenue Variance Dashboard