Balanced Scorecard Report for Credit Union Branches

What is

a

Balanced Scorecard

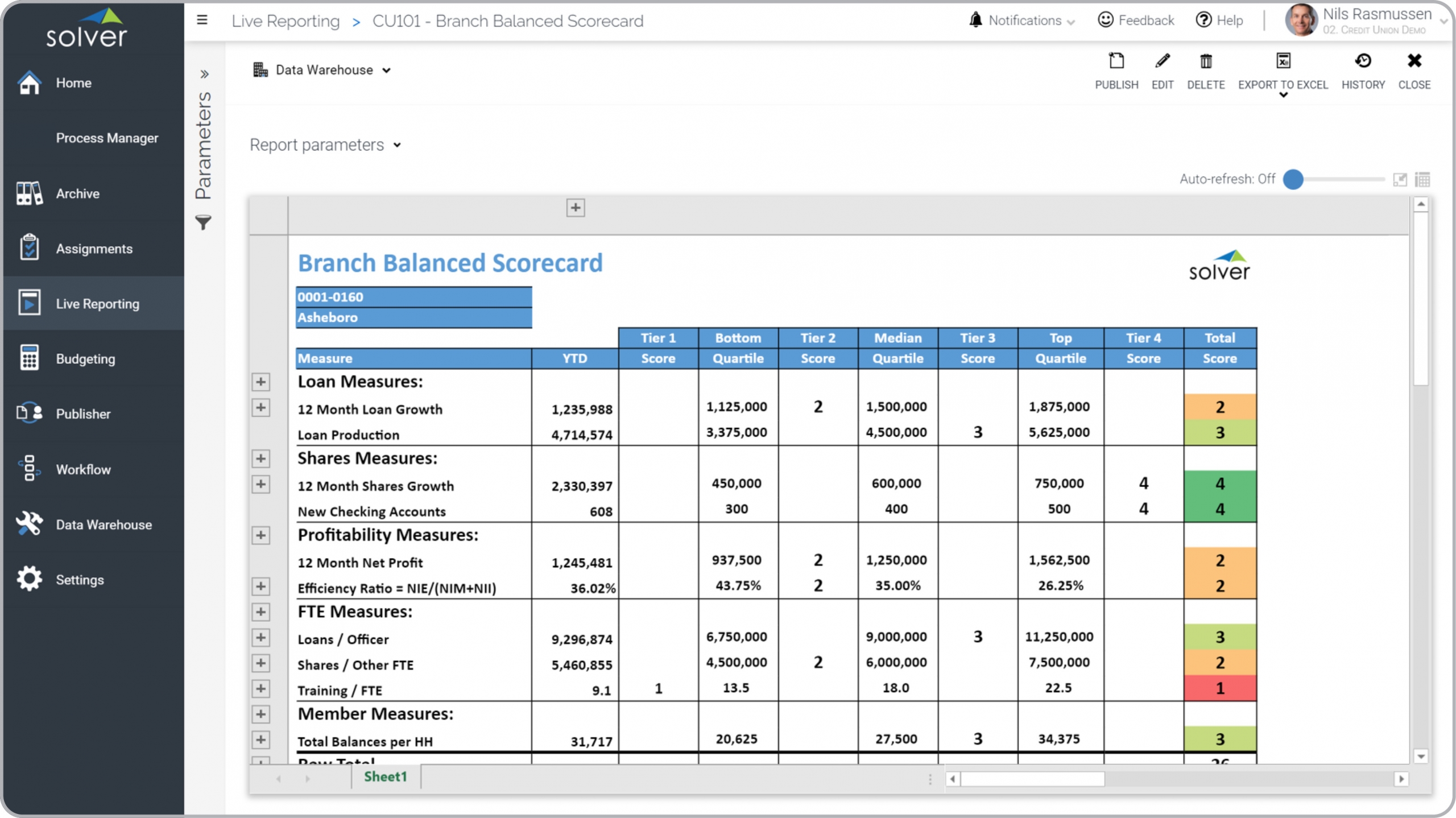

? Balanced Scorecard Reports are considered KPI tools and are used by executives and managers to measure branch performance. Some of the main functionality in this type of strategic report is that it presents a total score per credit union branch based on a series of strategic KPIs. These include: Loan measures, Shares measures, Profitability measures, FTE measures, and Member measures. You find an example of this type of strategic report below.

Purpose of

Balanced Scorecard Reports Credit Unions use Balanced Scorecard Reports to give leaders a tool to measure the success of their branches in executing on the company's strategies. When used as part of good business practices in Executive- and FP&A departments, a company can improve its branch managers' alignment with the corporate strategy and increase its performance. It can also reduce the chances that branch leaders invest time and resources in areas outside of corporate plans and goals.

Example of a

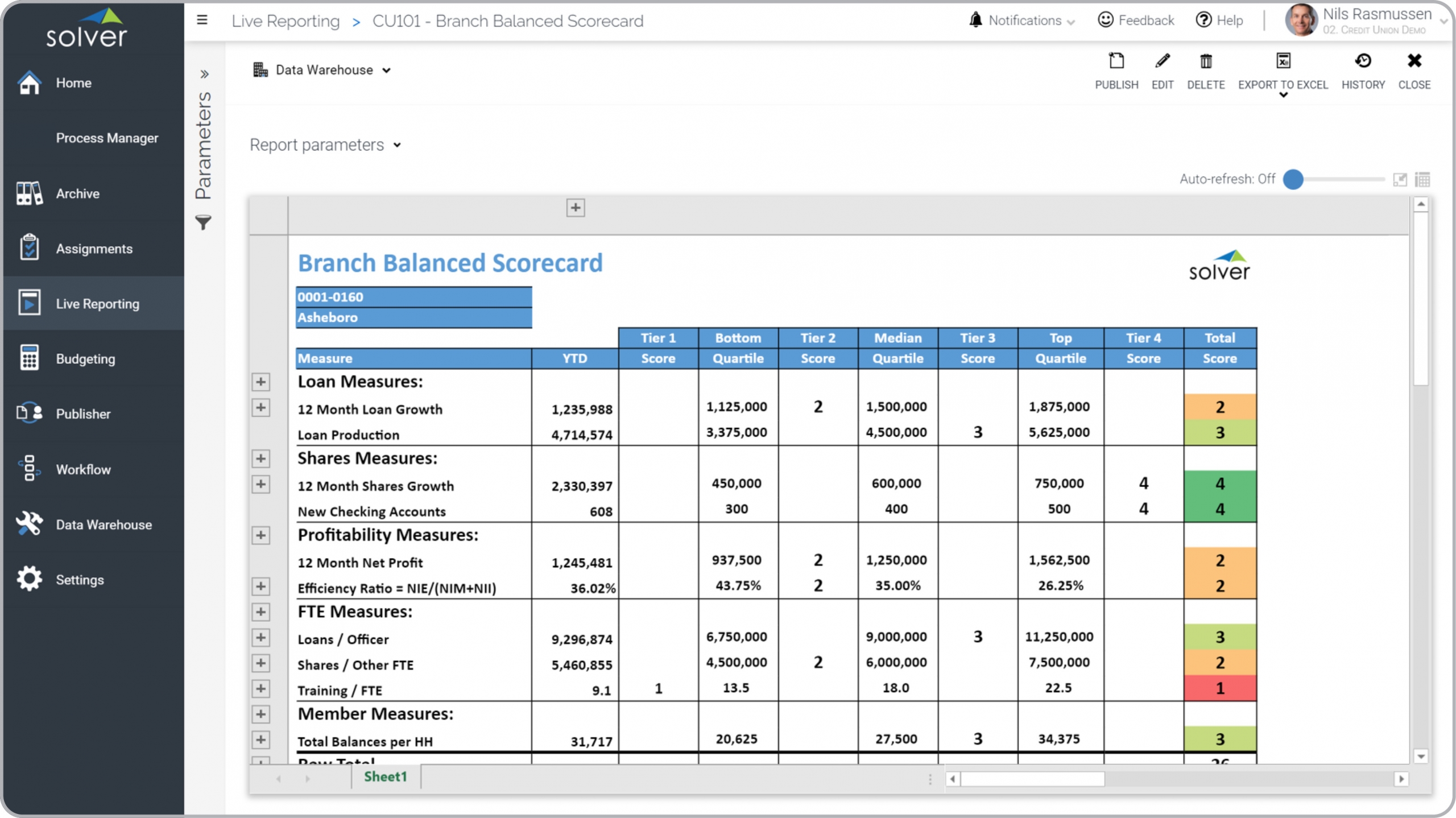

Balanced Scorecard Report Here is an example of a Branch Balance Scorecard Report with strategic measures, values and scores. [caption id="" align="alignnone" width="2560"]

Example of a Balanced Scorecard Report for Credit Union Branches[/caption] You can find hundreds of additional examples

here

Who Uses This Type of

Strategic report

? The typical users of this type of strategic report are: Executives, branch managers, finance leaders, analysts.

Other Reports Often Used in Conjunction with

Balanced Scorecard Reports Progressive Executive- and FP&A departments sometimes use several different Balanced Scorecard tools, along with profit & loss reports, balance sheets, cash flow statements, KPI reports, executive dashboards, budget models, forecasts and other management and control tools.

Where Does the Data for Analysis Originate From? The Actual (historical transactions) data typically comes from various point solutions, surveys and enterprise resource planning (ERP) systems like: Microsoft Dynamics 365 (D365) Finance, Microsoft Dynamics 365 Business Central (D365 BC), Microsoft Dynamics AX, Microsoft Dynamics NAV, Microsoft Dynamics GP, Microsoft Dynamics SL, Sage Intacct, Sage 100, Sage 300, Sage 500, Sage X3, SAP Business One, SAP ByDesign, Acumatica, Netsuite and others. In analyses where budgets or forecasts are used, the planning data most often originates from in-house Excel spreadsheet models or from professional corporate performance management (CPM/EPM) solutions.

What Tools are Typically used for Reporting, Planning and Dashboards? Examples of business software used with the data and ERPs mentioned above are:

Example of a Balanced Scorecard Report for Credit Union Branches[/caption] You can find hundreds of additional examples

here

Who Uses This Type of

Strategic report

? The typical users of this type of strategic report are: Executives, branch managers, finance leaders, analysts.

Other Reports Often Used in Conjunction with

Balanced Scorecard Reports Progressive Executive- and FP&A departments sometimes use several different Balanced Scorecard tools, along with profit & loss reports, balance sheets, cash flow statements, KPI reports, executive dashboards, budget models, forecasts and other management and control tools.

Where Does the Data for Analysis Originate From? The Actual (historical transactions) data typically comes from various point solutions, surveys and enterprise resource planning (ERP) systems like: Microsoft Dynamics 365 (D365) Finance, Microsoft Dynamics 365 Business Central (D365 BC), Microsoft Dynamics AX, Microsoft Dynamics NAV, Microsoft Dynamics GP, Microsoft Dynamics SL, Sage Intacct, Sage 100, Sage 300, Sage 500, Sage X3, SAP Business One, SAP ByDesign, Acumatica, Netsuite and others. In analyses where budgets or forecasts are used, the planning data most often originates from in-house Excel spreadsheet models or from professional corporate performance management (CPM/EPM) solutions.

What Tools are Typically used for Reporting, Planning and Dashboards? Examples of business software used with the data and ERPs mentioned above are:

- Native ERP report writers and query tools

- Spreadsheets (for example Microsoft Excel)

- Corporate Performance Management (CPM) tools (for example Solver)

- Dashboards (for example Microsoft Power BI and Tableau)

Corporate Performance Management (CPM) Cloud Solutions and More Examples

August 26, 2021

TAGS:

Reporting,

Solver,

KPI report,

report writer,

Microsoft,

template,

practice,

Acumatica,

metric,

Netsuite,

Finance,

credit union,

planning,

GP,

fintech,

Business Central,

excel,

ax,

Balanced Scorecard,

forecast,

Budget,

Dynamics 365,

budgeting,

KPI,

bank,

Cloud,

Software,

branch scorecard,

Tableau,

SAP,

example,

best,

Sage,

BC,

D365,

NAV,

Intacct,

financial institution,

CPM,

report,

branch,

SL,

Management,

dynamics,

scorecard,

Power BI