Top Features to Look for in the Best Financial Reporting Software Apps

This article is part 2 of an 8-part series on evaluating the best CPM tools for your business. Part 2 focuses on feature sets within the best financial reporting software applications.

Financial reporting software that also offers consolidations and planning functionality belongs to a software category typically referred to as Corporate Performance Management (CPM). Some also refer to this as Enterprise Performance Management (EPM). Since most organizations are either currently planning to or have recently moved their ERP systems to the cloud, cloud-based financial reporting solutions are now more popular than ever. While native ERP report writers are able to produce financial statements and sub-ledger reports, they are generally not great at formatting and advanced formulas. Plus, since they are built into the ERP system, they can’t report on data in other data sources. So, almost always, companies export some or many of their reports to Excel to finalize and assemble them there. As a result, an entire industry of cloud-based reporting solutions has sprung up to take companies’ reporting automation and month-end close processes to the next level. There are numerous software vendors that now deliver independent reporting solutions, either stand-alone or as part of a CPM suite. As a result, during a software selection process you’ll need to carefully choose the solution that is RIGHT for your business. This means that the functionality must be right for your unique business and that it should support your industry-specific requirements. And, of course, the

return on investment (ROI) needs to be positive. When working through a software selection process to find the best financial reporting software for your organization, there are always some features that are more important than others.

Here are some of the top features to look for to find the best financial reporting software While most vendors can probably showcase more than 100 features in their product (something which can make software selection a painful process), the main success criteria can be narrowed down to a few key areas. Each one is listed and discussed below.

- Advanced report formatting

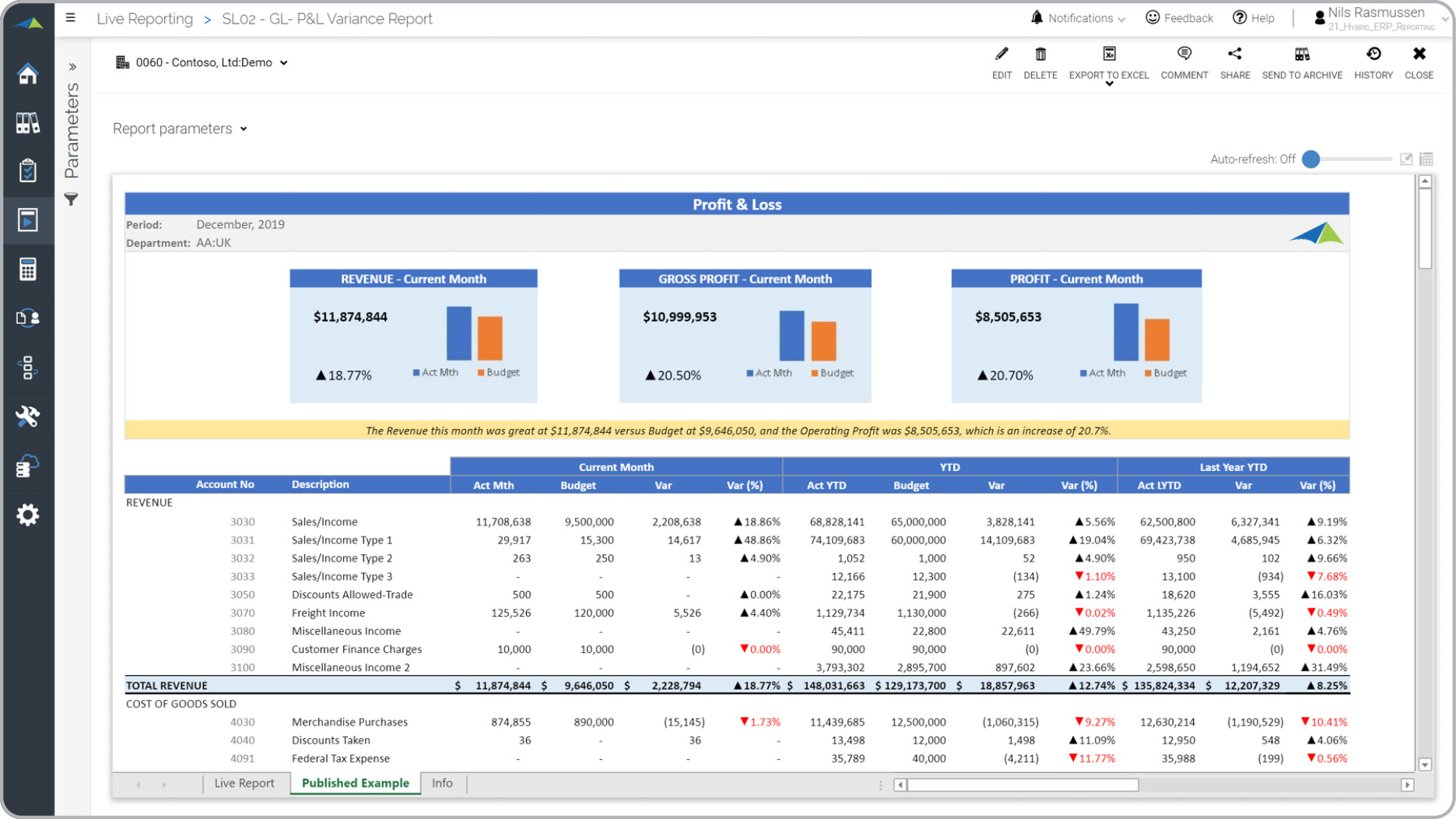

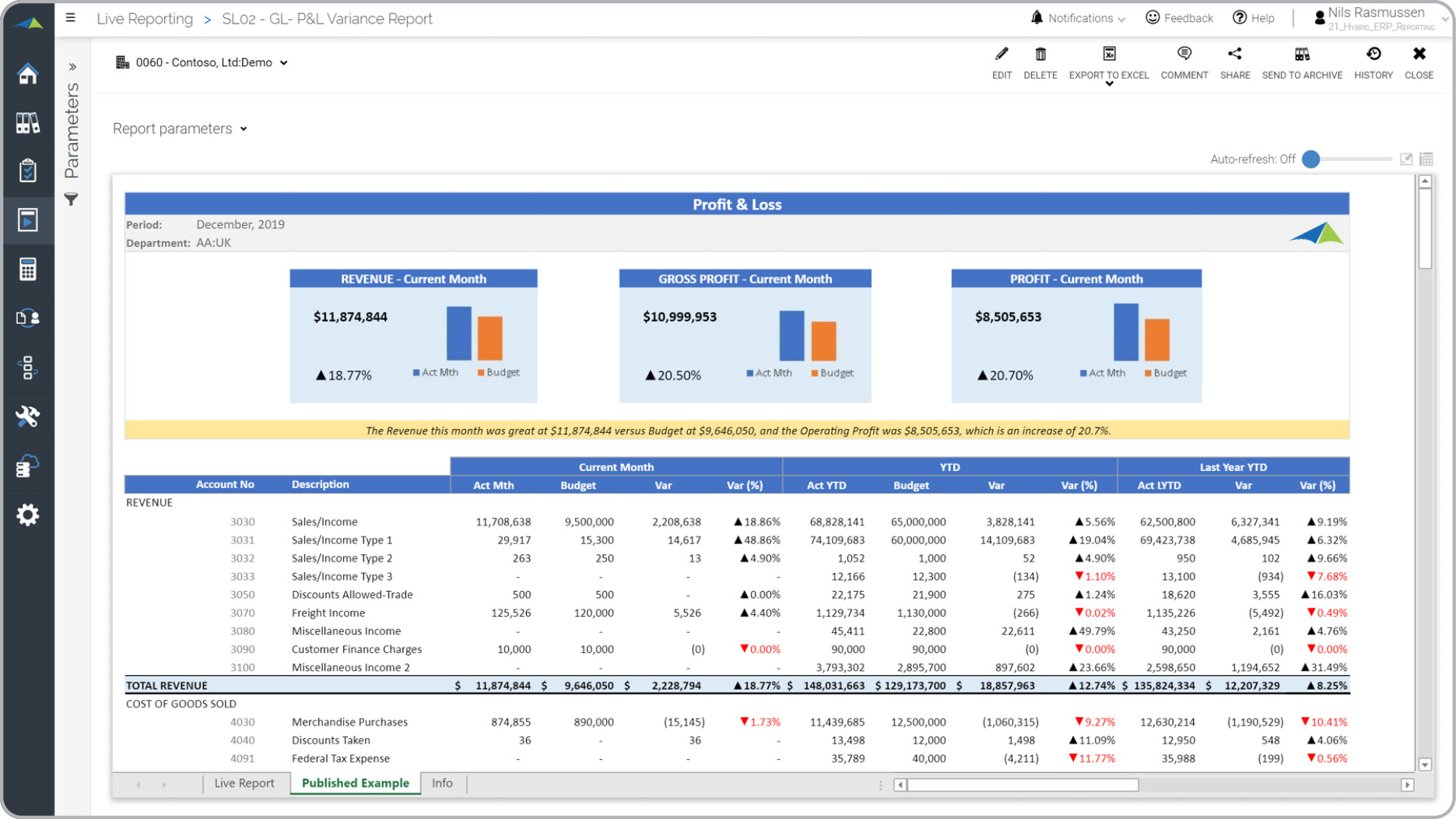

Per definition, all good report writers have a “template designer” to create reusable, parameter-driven reports. In addition to the pre-built reports that leading vendors should provide out of the box, the report designer is where a trained user or consultant can build new templates such as Profit & Loss reports and Balance Sheets specific to the needs of the business. About half of the CPM vendors offer

add-ins to Microsoft Excel where templates are designed. This typically provides the best formatting and layout flexibility. Plus, almost all finance department team members are very familiar with Excel already, so having a report writer built into Excel shortens the learning curve. Other vendors have built proprietary report designers so users can design financial reports, but these never contain all the formatting capability of Excel. A few vendors not only provide Excel report design, but they provide a cloud web portal where end users can run the templates as web reports from any device and with no Excel add-ins needed.

P&L – Variance Report (Copyright - Solver, Inc.)

Note 1: Be aware of CPM vendors that offer two report designers because that means twice as much training for power users. It can become messy in the month-end close process, report packages, and other areas if templates are created with two different technologies. The reason for two tools is almost always that the functionality in the vendor’s proprietary designer was not enough for their customers, so they later added an Excel designer to handle complex customer models with a lot of formatting.

Note 2: In addition, be aware of sales pitches that use “sexy” dashboards to draw your attention away from questions around great formatting in financial statements. While dashboards are awesome management tools focused on graphical analysis, they are NOT built to be financial report writers that can easily develop and maintain things like GL account structures behind Profit & Loss, Balance Sheets, Cash Flow Statements, and other critical reports. Without a report designer in your new planning solution, you are at high risk of significantly having to change your favorite report formats to fit the capability of the vendor’s tool. In many cases, you may even find yourself and your staff relying still on your overloaded Excel spreadsheets because you’ll be exporting reports to Excel and then manually reformatting them every month.

Here is list of about 500 examples of reports, dashboards, and budgeting templates. It is a good idea to ask your vendor candidates if you can see examples from their template libraries. The more examples they provide, the more you can be assured that their solution has a good report designer.

- Advanced formulas

Financial reports are some of the hardest reports to build due to diverse accounting calendars, complex or changing charts of accounts, and the custom ratios and calculations needed to measure performance. These formulas and ratios, typically created in Excel, can be difficult or impossible to translate into a solution that uses proprietary formulas or pre-set calculations. Formula familiarity is also important. Again, Excel is the

de facto standard, not just in formatting but in formulas. For this reason, most reporting vendors either create their report designer in Excel or try to mimic Excel formulas in their proprietary tool. Without a strong and familiar formula capability in your new report designer, there is a high risk that you will be dependent on consultants to help with report design on an ongoing basis, and/or that your finance team will waste hours every month dumping reports into Excel to “fix” them.

- Advanced consolidations

While all financial report writers can aggregate data across accounts and departments, a much smaller number of

solutions can perform true consolidations. In addition to consolidating financials across subsidiaries and divisions to produce high-quality corporate reports, important features include:

- Manual intercompany elimination entries with comments and audit trail

- Automatic intercompany eliminations

- Currency conversion

- Roll-up of balances from subsidiaries with different chart of accounts

- Ability to enter and track additional “topside” adjustments where needed

A best-of-breed solution will also have business rules such as trees and/or dimension attributes that automatically include new accounts without having to manually update reports or run the risk that monthly financial reports are wrong or incomplete. Some ERP systems do a pretty good job at handling this internally, but usually with a lot less flexibility than a true CPM reporting solution.

- Advanced closing and reporting process checklist

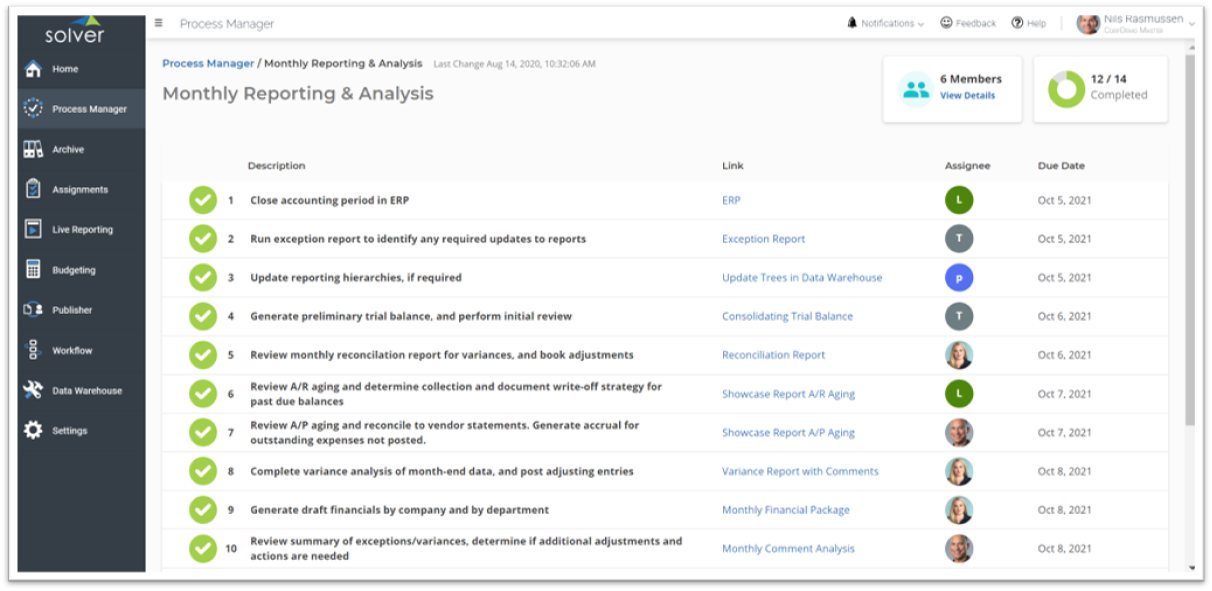

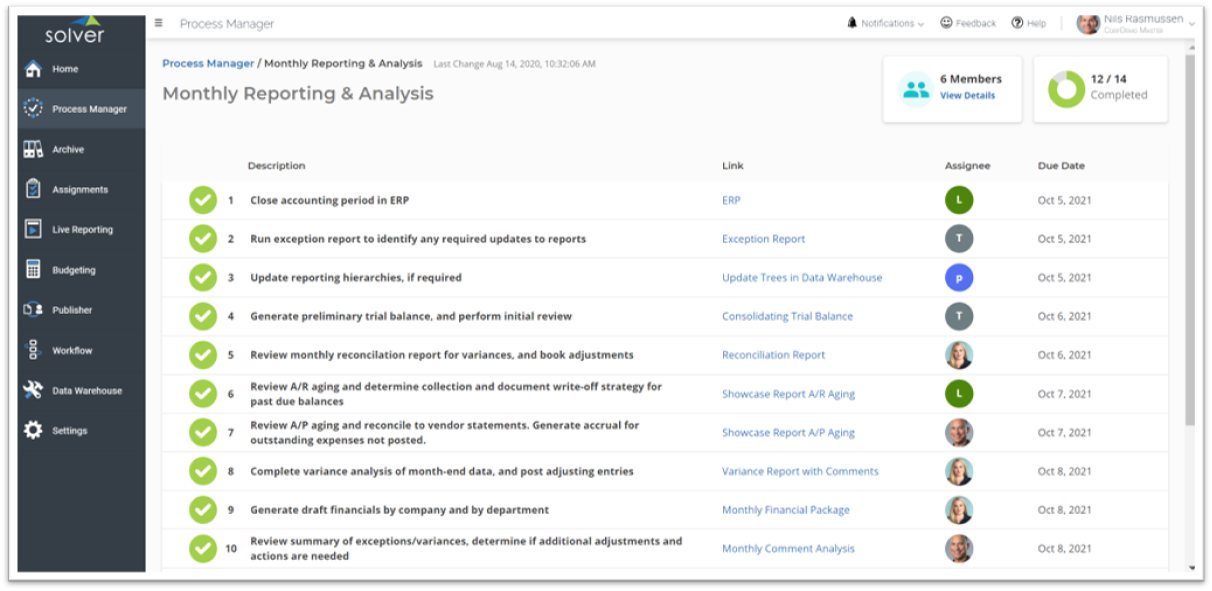

While most modern cloud-based CPM reporting solutions offer a workflow module, checklists are rarer. A financial reporting process checklist is typically a chronologically organized list of all the items a controller has to perform or oversee in the month-end close as it relates to reporting. Sometimes this includes 100 or more individual tasks with many people involved. Major steps include:

- Closing of the books in the ERP system and transferring the data to the reporting solution

- Viewing exception and reconciliation reports to flag issues and reconcile items

- Running trial balance reports

- Adjusting entries (in ERP or CPM tool)

- Running of all month-end reports

- Performing variance and trend analysis with comments

- Publishing (web viewing, email, or Excel) monthly reports with comments

- Sending PowerPoint presentations to the executive team

The top reporting solutions offer interactive checklists to help ensure that everything gets done on time. They often include functionality like checkboxes, descriptions, responsible people, links to activity, deadlines, and notifications.

Interactive Checklist for Monthly Reporting

Without a good workflow module and checklists, chances are good that you are spending a lot more time reminding people of deadlines and asking them for feedback or comments. This level of constant follow up can get even more frustrating and complex if you are stuck managing tasks manually in companies that have multiple subsidiaries and large accounting teams involved in the month-end close.

- Pre-built ERP integrations

All good CPM reporting solutions, by definition, have to be able to integrate with your ERP system’s General Ledger balances at the minimum. However, not all tools are great at reporting on other data. Along the same lines, some reporting solutions have better integrations to certain ERPs than others. Here are some questions to ask different vendors during your evaluation process:

- Is the integration to your ERP in real time or is data exported to the CPM solution’s cloud database? (There are pros and cons of both.)

- How frequently can the data from the ERP be refreshed within the reporting tool?

- Is the ERP integration pre-configured or do you have to map and configure it?

- Does the report writer only work well with GL data or can you also bring in sub-ledger transactions and non-ERP data?

- Will the integration pick up changes such as new accounts and companies?

When you are evaluating different CPM vendors for your financial and operational reporting needs, you should request detailed information about each solution’s integration to your systems, including estimates on the time and cost it takes to get them configured. A really good, pre-built integration should take

at the most an hour to configure, while “toolboxes” can take days to set up and connect to each data source. Which one your vendor offers will therefore usually become clear when you see their estimates for the integration step in the implementation. Without good, automated integrations to your source systems, your users will end up spending a lot of wasted time on loading and possible “cleaning” of data.

Here is an example of the advantages of a pre-built ERP integration and how it can enable users to get immediate, “day one” benefits from out-of-the-box budget and forecast input forms, reports and dashboards.

- Built for cloud

While on-premises financial reporting solutions were the standard technology for decades, today it is cloud solutions that rule. CPM reporting tools that are built with native cloud architecture offer many benefits over the classic on-premises solutions. These benefits include back-end functionality such as multi-tenancy to allow for efficient and frequent upgrades, spreading of processing and data loads across hardware resources, and otherwise taking advantage of what large public cloud data centers and platforms have to offer. As an example, in the old on-premises world, it was normal to do an annual upgrade for your software, while in the cloud world it is the norm to expect completely free and automated monthly updates. These regular updates also provide users with a continuous stream of new features and bug fixes. Highly flexible cloud solutions will still allow end users to run and view reports in both Excel and their web browser (no software installation needed on users’ computers). Make sure that both interfaces use the same report definitions (not two different reporting technologies) and allow for live drill-down into transaction details whenever the user needs to analyze at a deeper level. Without a purpose-built cloud architecture, a vendor will fall behind their competitors over time. A number of the legacy on-premises vendors did

not rebuild their technologies to be optimized for the cloud and, as a result, they will at some point have to rebuild their product or their customers will migrate to other vendors.

How much does a financial reporting solution cost? While it is important to do your homework to ensure that the vendor you choose has the key features needed for a successful deployment, it is also important to consider your total cost and savings in time and effort, as well as the solution’s potential to improve decision making at your company. Here are some things to think about when you get prices from your vendor finalists:

- Does the annual subscription from each vendor contain the same user count and modules?

- If you are receiving a discount, how long until it resets to the list price?

- Does the vendor have a written policy for annual price increases?

- Are the implementation estimates from each vendor for exactly the same work?

A good rule of thumb is to ask each vendor for the total subscription cost for the first 5 years. Make sure this includes any potential price increases. And, if the vendor is owned by a private equity firm, chances are that they will be sold while you are still a customer. In these cases, it is a smart choice to ensure that you receive a document that states their policy for price increases in the future,

including if they are sold to another company.

Here is a tool to help you compare vendors and calculate return on investment (ROI).

Why not use Excel or the financial reporting functionality in my ERP system? Excel is by far the world’s most popular reporting tool because it is free (if you already own Excel), incredibly flexible, and almost all accounting and finance professionals know how to use it. If you have a simple chart of accounts and not too many business units and departmental users, Excel may very well be the best financial reporting software for your business. However, everyone knows when it is time to replace their homegrown spreadsheet reports. Warning signals include:

- Painful manual report distribution

- Troubles with consolidation of spreadsheets

- Broken links

- Poor reporting flexibility

- Lack of user security

- Versioning issues

- and so on…

All ERP systems have basic reporting functionality, but these tools usually fail at great formatting, their ability to include non-ERP data, and their flexibility to manage account and company hierarchies dynamically within report definitions. The truth is that, regardless of an ERP vendor’s promotion of their built-in reporting features, companies almost always end up back in Excel for some of their reporting even after they buy a brand-new cloud ERP solution. Then, when Excel gets too painful, they acquire a CPM solution.

Conclusion In summary, choosing a new financial reporting solution to automate monthly reporting, as well as to cover other management reporting needs, promises to ultimately drive better and faster decisions at a company. This is why financial reporting ease is increasingly becoming a strategic priority for organizations across all industries. As we discussed earlier, certain features are more important than others and can be key drivers of success in addition to a well-executed implementation process.

Links to useful software research and evaluation assets

January 18, 2021

TAGS:

Reporting,

Solver,

report writer,

Microsoft,

Netsuite,

planning,

Business Central,

excel,

forecasting,

Dynamics 365,

budgeting,

Sage Intacct,

d365 finance,

CPM,

Power BI,

EPM,

consolidations,

best financial reporting software,

best software,

Management Reporter,

prophix,

PowerPoint,

best tools,

Excel-based budgeting,

Vena,

jet reports,

Excel-based reporting,

software comparison,

Azure,

SAP Business One,

sap bydesign,

dynamics nav,

best report writers,

best consolidation software,

dynamics gp,

best reporting software,

anaplan,

Adaptive Insight,

Planful,

Teams