High-Impact Ideas

Recent Posts

Is Forecasting Becoming More Important than Budgeting?

Is Forecasting Becoming More Important than Budgeting?

Recently, I was talking to a finance professional who oversees accounting processes and helps his organization make decisions about the future in regard to budgeting and forecasting. He posited that forecasting might be more important to running a business today than traditional budgeting – and it made me think. I’m always writing about the constantly evolving world of technology and the fast pace of today’s business culture, so shifting away from a traditional way of accomplishing data management and analysis tasks sparked my interest. Thus, this article will explore the differences between budgeting and forecasting to hopefully arrive at a better understanding of what is more impactful and productive to business today.

What is Budgeting and Forecasting?

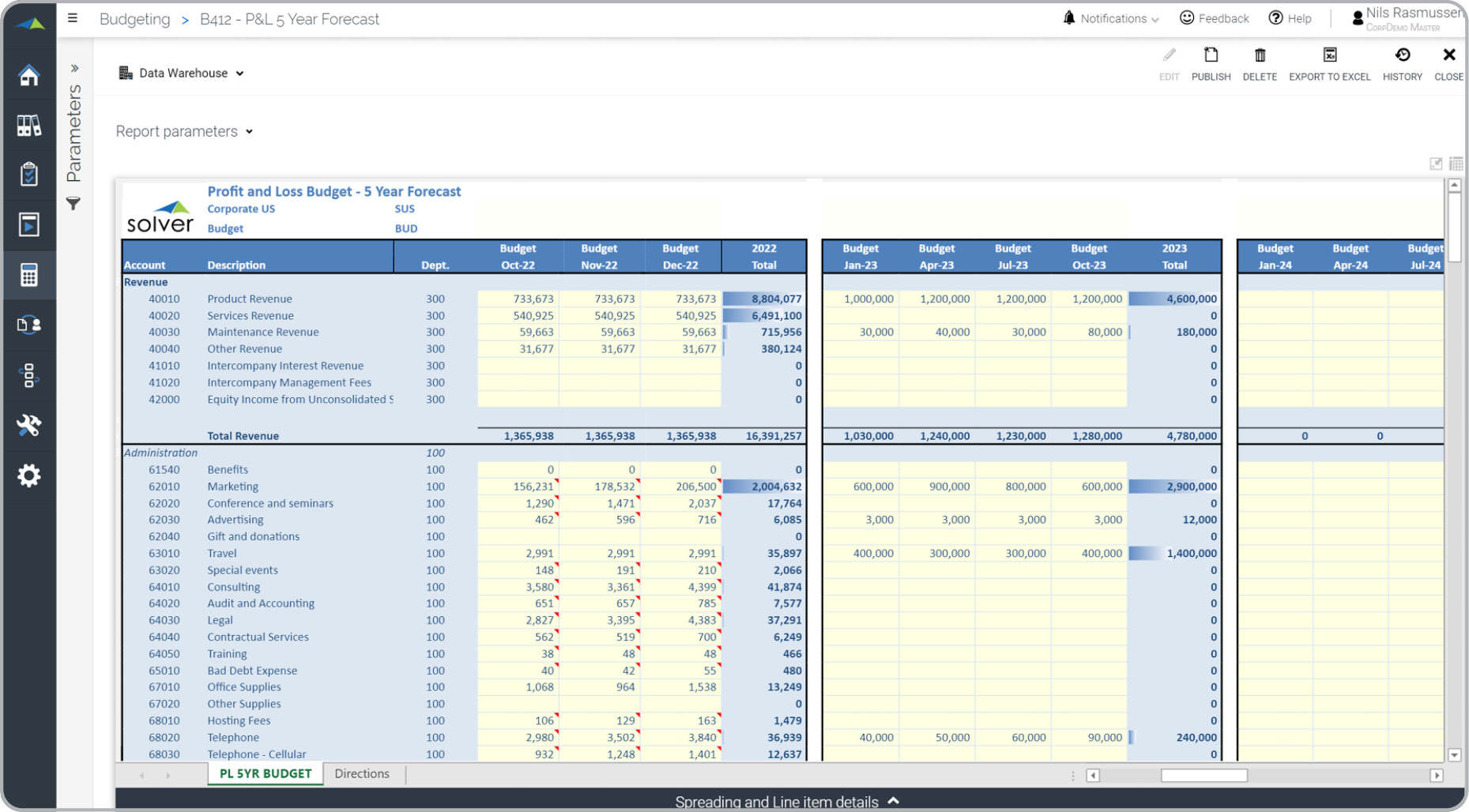

Budgeting and forecasting are distinct processes. Budgeting is a detailed and comprehensive compilation of how management envisions that the business will perform, in terms of results, financial positioning, and cash flows, for a specific period of time, usually a fiscal year. A budget is typically a fixed plan that is updated once a year, depending on how often management wants to tweak the data.

Budget users compare actual results to projected numbers in order to identify any variances in performance to come up with next year’s budget. Depending on the way the fiscal year goes, managers might take remedial steps along the way to bring actual results back on track with the budget. Finally, the projected to actual comparison can mean changes to performance-based compensation for employees.

Forecasting is an estimate of what will actually be accomplished. Forecasting is usually focused on just major revenue and expense line items – and doesn’t typically include financial position, but cash flows might be included in the forecast. The forecast is regularly updated, whether that is monthly or quarterly.

Forecasting can be utilized for short-term operational adjustments or considerations, as in sales performance, staffing, inventory, and/or production plans. Forecasting often does not involve the same level of variance analysis as budgets for comparison of what was forecasted to actual results. A forecast is often also used to figure out how you should allocate your budgets for a future year. And another way a forecast differentiates itself from a budget is that any changes in forecasting typically doesn’t affect performance-based pay for employees.

The Difference Between Budgeting and Forecasting

A forecast should be created in the same window of time as the business plan. If your business plan is for 3 years, your forecast should be the same length. Forecasts can be rolling or current month through the end of the year, updated with actual data every month to replace old budgets or estimates, and they are also reflecting any changes in the business plan. Of course, the record-keeping of a forecast also influences the business plan, so they’re mutually impactful on each other.

At this point in the evolution of business culture, in terms of how much companies rely on all kinds of data – and to be able to track on a monthly basis where the company is heading and how they’re getting to their goals, it seems like forecasting is logically the most important piece of your planning pie. That said, don’t anticipate business plans or budgets to go anywhere any time soon. Both benefit from the information captured in forecasting, and they also provide a point from where forecasting starts – and returns to, as actuals unfold.

A budget is a plan that is driven by taking a micro-analysis approach, whereas a forecast is usually completed on a macro level, which for many means at the General Ledger account level. A budget typically breaks down the year plan from the company to the customer, product, and employee level.

While budgets capture actuals as well, they have their own column next to the projected numbers. Your budget should be in line with the year as it is dictated in the business plan and the forecast, but is limited to the coming year. In other words, all three of these processes are linked and changes should be consistently made across the board. But where do these things occur on an organization’s calendar?

Your planning cycle will be specific to your organization, but planning can start in February. A business plan can be prepared in that first quarter, while the second half of the year is budgeting-dominant. Typically, a budgeting process wraps up in November or December to prepare for the next calendar year but can start in July. Meanwhile, once you establish your forecasting process, you’re updating monthly and reviewing perhaps yearly to look ahead, given actuals and assumptions. Once you understand the difference between the three in theory and in practice, particularly for your organization’s needs, you’ll be able to establish a cycle that serves your planning objectives the best.

Contact Solver to Learn More About Budgeting and Forecasting

Solver offers a planning module stand-alone and as part of the comprehensive suite of BI modules and would be happy to answer questions and generally review BI360’s easy-to-use budgeting and forecasting solution for collaborative, streamlined decision-making capabilities

TAGS: Finance, Business Central, excel, forecasting, Microsoft Dynamics, budgeting, SAP, D365, Intacct, NAVUG, Rolling Forecasts, GPUG, prophix, MSDSLUG, TM1, jet reports, BPC, DeFacto, sage x3, Sage 100, Host Analytics, SAP Business One, dynamics nav, Sage 300, cognos, Sage 500, AXUG, dynamics gp, Modeling, Centage, anaplan, Adaptive Insights, Multi-year Budgets

Global Headquarters

Solver Suite

Core Subscription

Company and Resources

© Copyright 2024, Solver All rights reserved.LegalPrivacy

QuickStart and Template Marketplace Overview (2 min) |QuickStart and Template Marketplace Setup (10 min)

Global Headquarters

Solver Suite

Core Subscription

Company and Resources

© Copyright 2024, Solver All rights reserved.LegalPrivacy

QuickStart and Template Marketplace Overview (2 min) |QuickStart and Template Marketplace Setup (10 min)

Global Headquarters

Solver Suite

Core Subscription

Company and Resources

© Copyright 2024, Solver All rights reserved.LegalPrivacy

QuickStart and Template Marketplace Overview (2 min) |QuickStart and Template Marketplace Setup (10 min)

Global Headquarters

Solver Suite

Core Subscription

Company and Resources

© Copyright 2024, Solver All rights reserved.LegalPrivacy

QuickStart and Template Marketplace Overview (2 min) |QuickStart and Template Marketplace Setup (10 min)